While India grows more guavas than any other nation, Mexico has firmly established itself as the world’s largest guava exporter by value. This distinction highlights a critical difference between production volume and export-oriented strategy, shaped by geographical advantages, market demand, and logistical capabilities that position Mexico as the dominant force in the international fresh guava market.

Key Insights: The Global Guava Market

| Key Fact | Detail / Statistic |

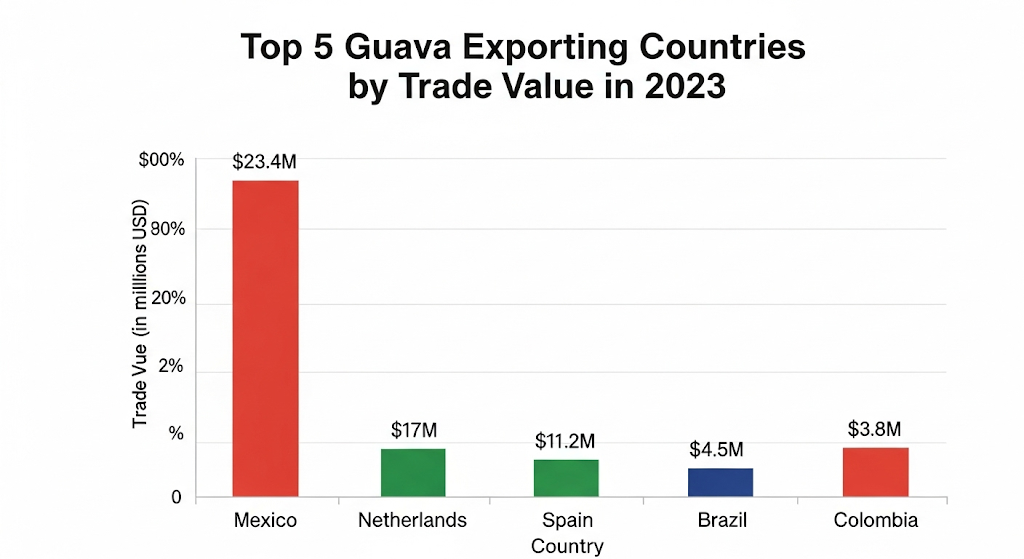

| Top Exporter (Value) | Mexico, with exports valued at approximately $23.4 million in 2023. |

| Top Producer (Volume) | India, producing over 26 million metric tons annually. |

| Top Importer | The United States, accounting for over 50% of global guava imports. |

| Key Industry Challenge | The fruit’s short shelf life, which limits long-distance sea freight. |

Mexico’s Dominance in Global Guava Exports

Mexico has strategically cultivated its role as the leading supplier of fresh guavas to the world; a success built largely on its proximity to the world’s biggest consumer: the United States. According to 2023 data from the International Trade Centre, Mexican guava exports reached a value of $23.4 million, placing it at the top of the global market.

The country’s success is not accidental. Mexican growers, primarily in states like Michoacán and Aguascalientes, focus on varieties that are well-suited for export. These guavas typically have firmer flesh and thicker skins, making them more resilient during transit. The close distance to the U.S. allows for rapid shipping via truck, preserving freshness and minimizing spoilage—a crucial advantage for such a perishable fruit.

“Mexico’s integration into the North American supply chain is its greatest asset,” said Dr. Isabella Rios, an agricultural trade analyst at the Council on Foreign Relations. “Tariff advantages under agreements like the USMCA, combined with mature logistics networks, give Mexican producers an edge that is difficult for more distant competitors to overcome for fresh produce.”

India: A Production Powerhouse Focused Inward

In stark contrast to Mexico’s export-driven model stands India, the undisputed giant of guava production. The country produces an estimated 45% of the world’s guavas, according to the Food and Agriculture Organization of the United Nations (FAO). However, the vast majority of this harvest never leaves the country.

Several factors contribute to this dynamic. Strong domestic demand deeply rooted cultural preference for the fruit, and a thriving local processing industry mean that Indian farmers have a large and reliable market at home. The logistical hurdles for exporting fresh Indian guavas to lucrative Western markets are also significant.

“The primary challenge is the fruit’s perishability,” stated a recent report from India’s Agricultural and Processed Food Products Export Development Authority (APEDA). “Maintaining the cold chain over long distances required to reach Europe or North America makes sea freight challenging, and air freight is often too costly to be competitive for fresh consumption.”

As a result, India’s agricultural exports in the guava sector are dominated by processed products like puree, pulp, and juice concentrate, which have a much longer shelf life and are easier to transport.

The Role of Re-Exporters and Other Key Players

The global guava market is more complex than a simple two-country comparison. The Netherlands, for example, consistently ranks as one of the top exporters. However, it is not a major producer. Instead, it functions as a critical trade hub for Europe, importing guavas from countries like Brazil and Colombia and then re-exporting them across the continent.

“Dutch dominance in logistics and its position as a gateway to the EU market allow it to play an outsized role in the distribution of exotic fruits,” explains a trade brief from the Centre for the Promotion of Imports from developing countries (CBI), an agency of the Netherlands Ministry of Foreign Affairs.

Other significant producers and exporters include Brazil, Colombia, Spain, and Thailand, each serving regional markets or specializing in particular varieties or processed goods. This diverse landscape of international trade ensures a year-round supply to meet growing global demand for the tropical fruit.

As consumer tastes in North America and Europe continue to diversify, the demand for tropical fruits like guava is projected to grow. This could create new opportunities for producers who can innovate in cultivation and logistics. Advances in breeding for longer shelf life and improved cold storage technology could eventually allow countries like India to compete more directly in the fresh export market.

For now, Mexico’s geographical advantage and strategic focus on the fresh fruit market keep it firmly in place as the world’s leading guava exporter. The dynamic underscores a fundamental lesson in global agriculture: growing the most is not the same as selling the most on the international stage.

Jamaica Solidifies Its Position as the World’s Leading Ackee Producer