India has solidified its position as the largest butter producer in the world, a distinction primarily fueled by its vast domestic dairy industry and a burgeoning demand for dairy products. While often associated with significant milk production, India’s preeminence in butter output underscores the scale of its internal consumption and the structure of its dairy cooperatives. This leadership is particularly noteworthy in a global butter market that experienced a 10.7% decrease in trade value in 2023, even as overall dairy consumption continues to rise worldwide.

The global butter market, valued at approximately $40.04 billion in 2023, is projected to grow to $58.16 billion by 2032, according to Fortune Business Insights. This growth is driven by factors such as rising population, increasing health consciousness, and the expanding foodservice sector. Despite this global growth, the dynamics of butter production are heavily influenced by regional consumption patterns and agricultural policies.

The Scale of Indian Dairy Production

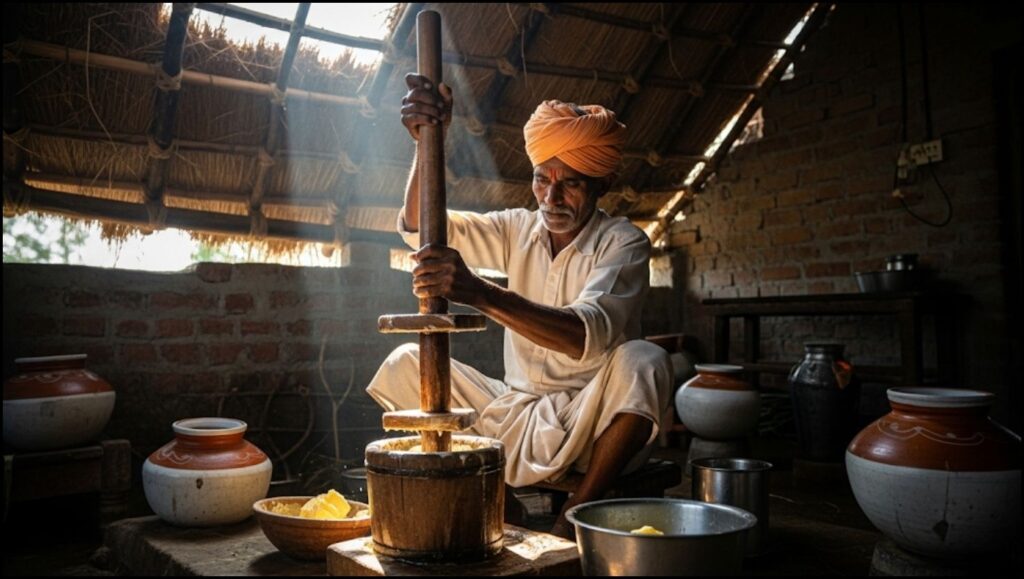

India’s dominance in butter production is intrinsically linked to its position as the world’s largest milk producer. The country’s dairy sector is characterized by a fragmented network of smallholder farmers and a strong cooperative movement. This structure enables a massive volume of milk to be collected and processed, with a significant portion allocated to traditional dairy products like butter and ghee.

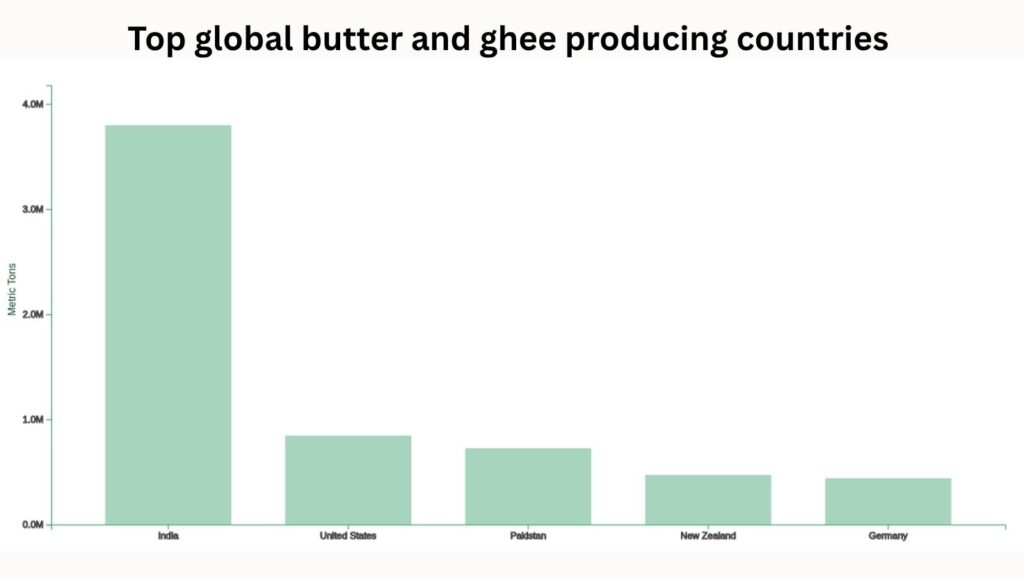

According to data from ReportLinker for 2023, the United States leads in combined butter and ghee production, followed closely by Germany and New Zealand. However, other sources, particularly those focusing on total milk fat production, indicate India’s overwhelming share. For instance, NationMaster, referencing 2019 data on ghee and butter production, positions India as the indisputable leader by a substantial margin, producing 4,532,362 metric tons, far exceeding the second-ranked Pakistan (1,056,183 metric tons) and the United States (865,658 metric tons). While some more recent trade-focused data may highlight export leaders, India’s output is primarily for its immense domestic market, meaning a significant portion does not enter international trade statistics as exports.

Factors Driving India’s Butter Output

Several interconnected factors contribute to India’s leading role in butter production:

- Massive Domestic Consumption: Butter, and its clarified form, ghee, are staples in Indian cuisine and culture. They are used extensively in cooking, religious ceremonies, and as a dietary component across households. This ingrained demand creates a vast internal market that absorbs the majority of the butter produced.

- Decentralized Dairy Farming: India’s dairy sector is largely decentralized, with millions of small and marginal farmers owning a few dairy animals. This widespread milk production forms the bedrock of the butter industry. Cooperative societies, such as the Gujarat Co-operative Milk Marketing Federation (Amul), play a pivotal role in aggregating milk from these farmers and processing it into various dairy products, including butter.

- Government Support and Policy: Indian government initiatives aimed at boosting milk production and supporting dairy farmers indirectly contribute to butter output. While there’s a push for higher overall milk production, the end-use often includes traditional products like butter.

- Cultural Significance of Ghee: Ghee, which is clarified butter, holds immense cultural and culinary importance in India. Its production consumes a significant amount of butterfat, further driving the overall demand for raw butter.

Global Butter Market Dynamics and Key Players

While India leads in total production, the international trade of butter is dominated by other nations. In 2023, the leading exporters of butter included New Zealand, Netherlands, and Ireland, according to The Observatory of Economic Complexity (OEC). These countries, particularly New Zealand, are known for their export-oriented dairy industries. Major importers included France, Germany, and the Netherlands, reflecting strong European demand.

The global butter market is influenced by various trends, including consumer preferences for natural fats, the rise of plant-based alternatives, and the increasing demand for processed food products that utilize butter as an ingredient. Companies like Fonterra Co-operative Group (New Zealand), Arla Foods (Denmark), and Dairy Farmers of America (U.S.) are major global players in the dairy and butter markets, focusing on product innovation and expanding their portfolios.

Challenges and Future Outlook

The global dairy industry, including butter production, faces several challenges. Climate change, for instance, poses a significant threat to milk yields. Studies in India have shown that rising temperatures can lead to a considerable drop in milk production, particularly affecting smallholder farmers who form the backbone of the country’s dairy sector. A 2022 study by the Indian Grassland and Fodder Research Institute estimated that, as temperatures rise, milk production in the northern plains of India could decrease by 361,000 tonnes by 2039, leading to substantial economic losses (Eco-Business).

Despite these challenges, the demand for butter is expected to remain robust, especially in emerging markets. The increasing per capita consumption of dairy products, coupled with urbanization and evolving dietary habits, suggests continued growth for the butter market. For India, maintaining its leadership will depend on its ability to adapt to climatic shifts, sustain its cooperative dairy model, and meet the growing demands of its vast population.

The trajectory of the global butter market will be shaped by a complex interplay of consumer preferences, environmental factors, and the resilience of dairy supply chains in major producing nations. As the largest butter producer, India’s domestic consumption patterns and agricultural policies will continue to exert a significant influence on global dairy statistics, even as it primarily serves its own substantial market.

Mexico Solidifies Position as the Largest Papaya Exporter in the World