China has firmly established itself as the world’s leading cauliflower producer, dominating global supply and influencing international market dynamics. The nation’s agricultural sector, backed by vast land resources and favorable climatic conditions, produces a massive quantity of the popular vegetable each year. This output far exceeds that of any other country, including India, which ranks second globally in cauliflower cultivation.

Recent data from international agricultural organizations highlights a duopoly in the global cauliflower market. According to the Food and Agriculture Organization of the United Nations (FAOSTAT), China and India together account for over 70% of the world’s total cauliflower production. While both nations are major players, China maintains a significant lead, producing over 10 million metric tons annually. This figure often represents nearly half of the world’s total output, underscoring its pivotal role in the industry.

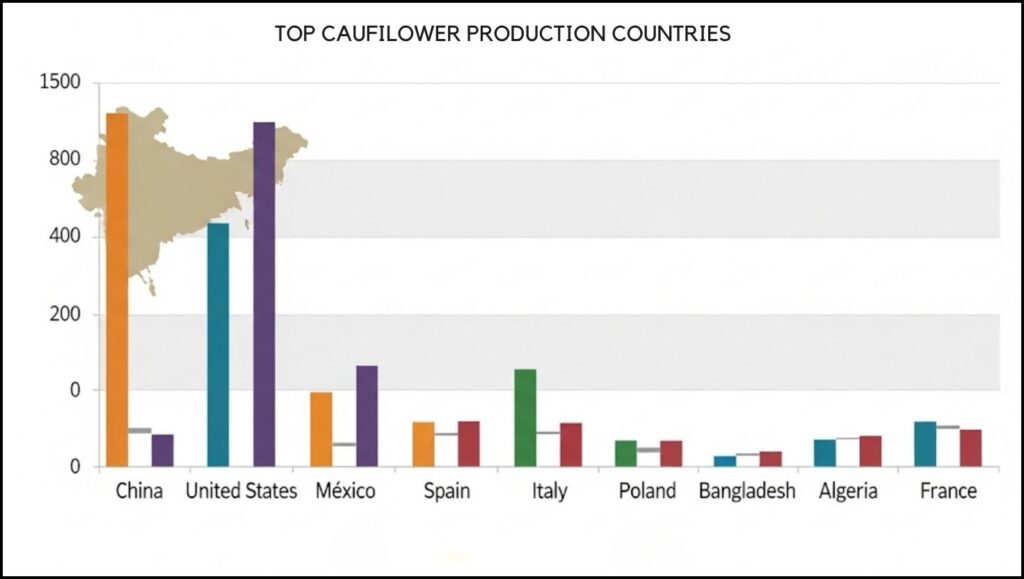

India, the second-largest producer, cultivates a substantial amount of cauliflower, but its annual output typically falls several million tons short of China’s. The United States, Mexico, and Spain are other notable players, but their production volumes are considerably smaller, each contributing less than 5% to the global total. This concentration of production in Asia gives these two countries immense influence over the global supply chain and pricing.

Factors Driving China’s Agricultural Dominance

Several factors contribute to China’s position as the largest cauliflower producer. One of the most critical is the country’s diverse climate and vast arable land. With a range of temperate and tropical zones, farmers can cultivate cauliflower varieties that thrive in different conditions, allowing for a year-round harvest in various regions. This geographic advantage is supplemented by extensive investment in agricultural infrastructure and technology.

Chinese farmers have increasingly adopted modern farming techniques, including the use of advanced hybrid seeds that offer higher yields, greater disease resistance, and improved quality. A report by market research firm Report Linker indicates that China’s agricultural sector is focused on technological advancements to enhance production efficiency. This focus on innovation, coupled with a robust domestic market demand for the versatile vegetable, solidifies the country’s lead.

Dr. Li Wei, a professor of agricultural economics at Peking University, commented on the trend. “China’s strategy has been to leverage both scale and technology,” Dr. Li said. “Our production capacity is immense, but it’s the continuous improvement in seed varieties and farming practices that truly sustains our position. We’re not just producing more; we’re producing more efficiently.”

The Role of Domestic Consumption and Export Markets

While a significant portion of China’s cauliflower harvest is for its own domestic market, the nation also plays a key role in the global export of fresh and processed cauliflower. The vegetable is a staple in Chinese cuisine and its consumption has been rising in line with population growth and changing dietary habits. This strong internal demand ensures that farmers have a reliable market for their crops, which in turn incentivizes high-volume production.

India, in contrast, also has a massive domestic market, but its export capabilities are still developing. The country’s cauliflower is a staple in many dishes and its market is driven by both traditional farming methods and a growing number of commercial operations. However, issues such as post-harvest waste and logistical challenges can sometimes hinder its full market potential, according to a recent analysis by the Indian Council of Agricultural Research (ICAR).

The global demand for healthy, low-carb food options has also spurred innovation in the cauliflower market. Products like cauliflower rice and pizza crusts have become popular in Western markets, creating new export opportunities for major producers.

Economic and Environmental Implications

The sheer scale of cauliflower production in China and India has both economic and environmental consequences. On the economic front, their dominance keeps global prices relatively stable, providing a consistent supply for international consumers. This stability is crucial for food security and can protect smaller economies from price volatility. However, it also means that smaller-scale producers in other countries often struggle to compete with the low costs of Chinese and Indian exports. From an environmental standpoint, large-scale agriculture raises concerns about water usage, land degradation, and the carbon footprint of transportation. The cultivation of Brassica oleracea crops like cauliflower requires substantial irrigation, which can strain local water resources. Furthermore, the global shipping of fresh vegetables contributes to greenhouse gas emissions.

Experts suggest that future trends in the market will likely focus on sustainable agriculture and improved supply chain logistics. Maria Gonzalez, a sustainability analyst at the World Resources Institute, stated, “The challenge for the largest producers is to balance their output with environmental stewardship. This means investing in water-efficient irrigation, reducing waste, and shortening supply chains where possible.”

China’s position as the world’s leading cauliflower producer is a result of a powerful combination of geographic advantages, strategic government support, and technological innovation. While its dominance is clear, the global market remains a dynamic landscape shaped by key players like India and a growing worldwide consumer demand for this nutritious vegetable. As the industry evolves, the focus is shifting toward not only production volume but also efficiency, sustainability, and the ability to adapt to new culinary trends.

India Solidifies Position as Largest Ghee Producer in the World Amid Growing Global Demand