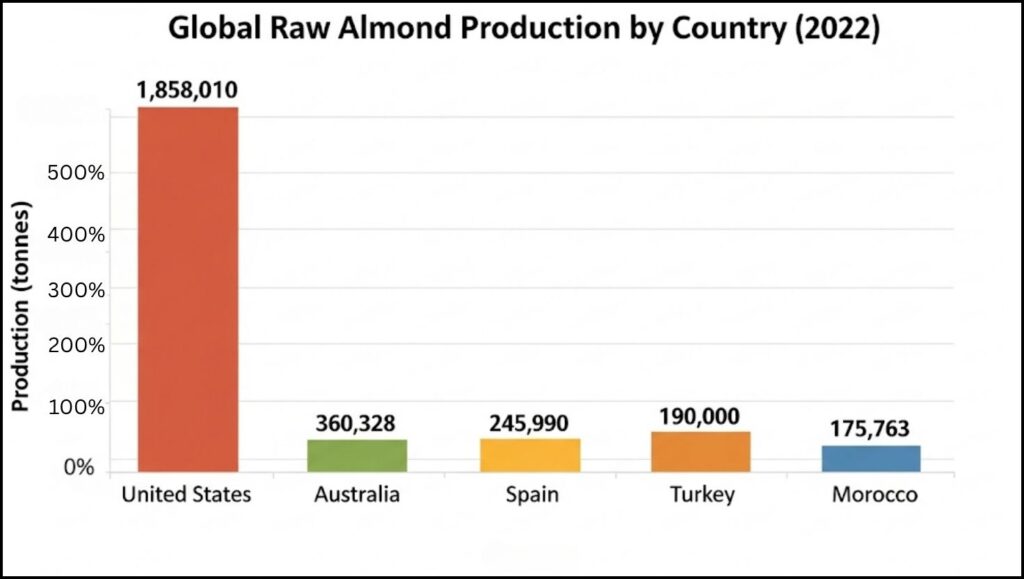

The United States is the undisputed largest almond milk producer in the world, a status directly linked to its near-monopoly on raw almond cultivation. This leadership position in the rapidly expanding global plant-based milk industry is overwhelmingly powered by the state of California, whose vast orchards supply the core ingredient for brands consumed both domestically and across the globe.

Key Insights: The U.S. Almond Milk Sector

| Key Fact | Detail / Statistic |

| Top Producer | The United States is the #1 producer of both raw almonds and finished almond milk. |

| Core Driver | California grows approximately 80% of the world’s almonds and nearly 100% of the U.S. commercial supply. |

| Market Value | The global almond milk market was valued at over $5.3 billion in 2023 and is projected to continue growing. |

| Primary Challenge | Significant water usage for almond cultivation in drought-prone California remains a key environmental concern. |

How California Dominates the Supply Chain

The U.S. position as the largest almond milk producer is not due to a unique manufacturing process but rather its control over the primary resource. California’s Central Valley offers a rare Mediterranean climate ideal for almond cultivation, a key reason why the state produces around 2.5 to 3 billion pounds of almonds annually, according to the U.S. Department of Agriculture (USDA).

This agricultural dominance creates a highly efficient vertical supply chain. Major almond milk brands and processors, including Blue Diamond Growers—a cooperative representing over 3,000 California growers—and Califia Farms, are based in the state. This proximity of farms to processing plants reduces transportation costs and allows for a seamless transition from raw nut to packaged beverage.

“The synergy between our growers and processors is fundamental to the scale of the U.S. industry,” explained a representative from the Almond Board of California. “Decades of investment in farming techniques, processing technology, and product development have solidified this leadership.”

The Global Almond Milk Market and Consumer Demand

While the U.S. produces the most almond milk, consumption is a global phenomenon. The international almond milk market is fueled by worldwide consumer shifts toward plant-based diets, driven by health, environmental, and ethical considerations. Almond milk has become a staple for consumers with lactose intolerance and those seeking lower-calorie alternatives to traditional dairy.

According to a 2024 market analysis by Grand View Research, North America remains the largest market for consumption, but Europe and the Asia-Pacific region are experiencing rapid growth. In Europe, Spain stands as a significant almond grower and producer, though its output is dwarfed by California’s.

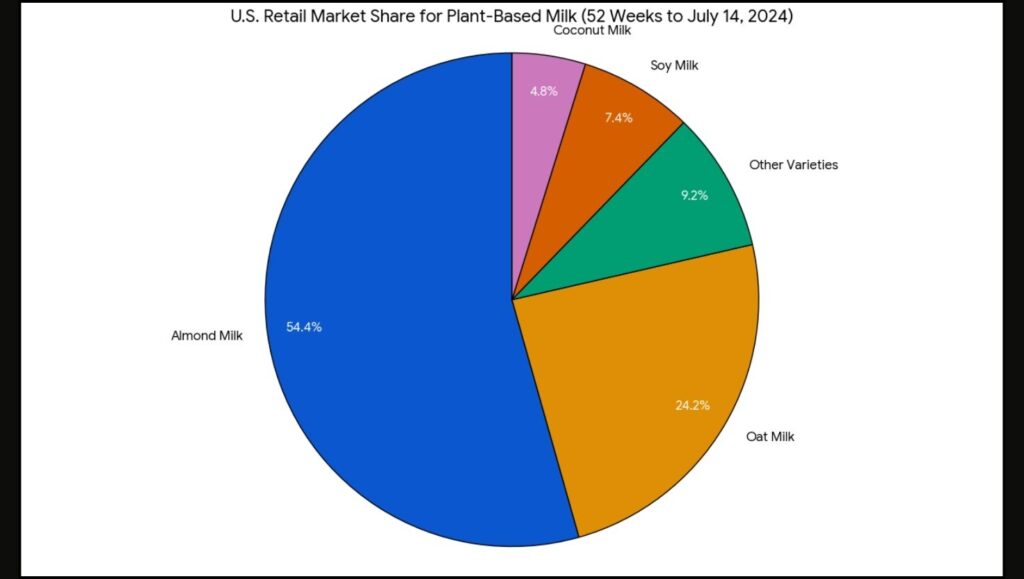

“We see a clear trend of consumers diversifying their milk choices,” said Dr. Eleanor Vance, a food industry analyst at a leading market research firm. “Almond milk had a first-mover advantage in many Western markets and became synonymous with ‘dairy-free.’ While other milks, especially oat, are gaining traction, almond milk’s established presence gives it a strong foundation.”

The Water-Intensive Debate and Industry Response

The success of California almond production is shadowed by significant environmental concerns, most notably its water consumption. Growing a single almond commercially requires over a gallon of water, a fact that draws intense scrutiny in a state frequently beset by severe drought. This has led to criticism from environmental groups and challenging policy decisions regarding water allocation for agriculture.

In response, the industry has emphasized its efforts to improve water efficiency. The Almond Board of California reports that growers have adopted micro-irrigation and other advanced farming techniques, reducing the amount of water needed to grow a pound of almonds by 33% since the 1990s.

“No one is more attuned to the need for water conservation than the farmers whose livelihoods depend on it,” a statement from the board noted. “Continuous improvement in sustainable farming is a core priority for the California almond community.”

Competition in the Plant-Based Aisle

Despite its market leadership, almond milk faces fierce competition. The rise of oat milk has been particularly disruptive, with its creamy texture and strong environmental marketing resonating with consumers and coffee shops. Data from the Plant-Based Foods Association shows oat milk sales growing at a faster rate than almond milk in recent years.

Soy milk, a long-standing dairy alternative, and newer options like pea and coconut milk also compete for shelf space. This crowded market forces almond milk producers to innovate, with new products like extra-creamy blends, protein-fortified versions, and various flavorings designed to retain consumer interest.

Looking ahead, the U.S. is poised to remain the leading producer of almond milk as long as California’s orchards continue to dominate global almond supply. However, its market share will be increasingly challenged by both environmental pressures at home and the rise of popular alternatives on store shelves worldwide. The industry’s ability to navigate water sustainability and innovate in a competitive landscape will determine its long-term trajectory.

India Emerges as Largest Butter Producer, Driven by Domestic Consumption and Dairy Sector Growth