Indonesia, a sprawling archipelago nation, has solidified its position as the largest coconut milk producer in the world. The country’s vast plantations and advanced processing infrastructure have made it a dominant force in the global market for coconut-based products. This leadership is not only an economic driver for Indonesia but also a crucial component of the international food supply chain, as demand for plant-based and lactose-free products continues to surge worldwide.

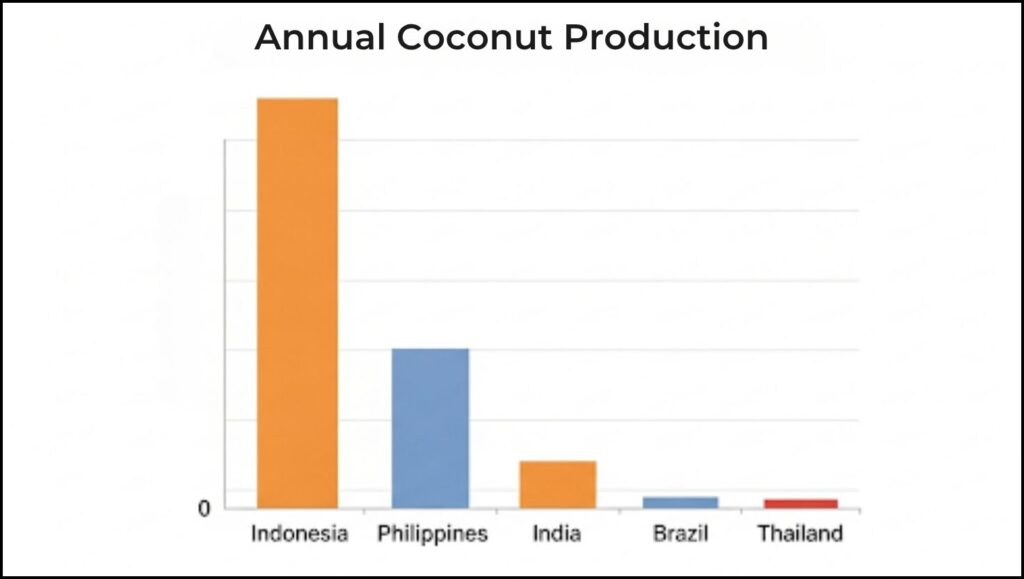

According to a 2024 report by the Food and Agriculture Organization (FAO), Indonesia leads the world in coconut production, with an annual output exceeding 17 million metric tons. The nation’s equatorial climate, consistent rainfall, and fertile soil provide ideal conditions for coconut cultivation, supporting a robust industry that extends far beyond the fresh fruit. The coconuts grown here form the foundation for a wide range of goods, including coconut oil, desiccated coconut, and, most notably, coconut milk.

Economic Backbone: The Coconut’s Role in Indonesia

For Indonesia, the coconut industry is more than just a major export sector; it is a fundamental pillar of its rural economy. The cultivation and processing of coconuts provide livelihoods for millions of farmers, particularly in coastal and island communities. The Indonesian government and private sector have invested significantly in modernizing this industry, moving beyond the traditional export of raw copra (dried coconut meat) to focus on higher-value processed goods.

This shift has enabled Indonesia to capitalize on global consumer trends, particularly the growing preference for healthier, natural, and plant-based foods. Coconut milk, in its liquid and powdered forms, has become a staple ingredient in kitchens across Asia, Europe, and the Americas. It is a core component of many Southeast Asian cuisines, such as Thai curries and Indonesian rendang, but its versatility has also made it a popular alternative to dairy milk for vegans and individuals with lactose intolerance.

“Indonesia’s strength lies in its ability to manage the entire coconut value chain, from smallholder farms to large-scale, automated processing plants,” said Dr. Sarah Chen, an agricultural economist specializing in Southeast Asian markets. “This integration allows them to produce high-quality, consistent products, which is essential for meeting the stringent standards of international buyers.”

The Southeast Asian Coconut Triangle

While Indonesia leads in total volume, it is part of a larger regional dynamic. The Philippines and India are also major players, forming a “coconut triangle” in Asia that collectively accounts for a significant portion of the world’s coconut supply.

- The Philippines: The second-largest producer, the Philippines is a major exporter of virgin coconut oil and desiccated coconut. Its industry supports over 3.5 million farmers and is a critical economic engine for the country. The government has prioritized replanting programs and fair-trade initiatives to maintain its market position.

- India: A domestic giant, India is the third-largest producer but consumes most of its coconuts internally. The fruit is deeply embedded in Indian culture, religion, and cuisine, particularly in the southern states of Kerala and Tamil Nadu. While a smaller exporter of finished products compared to its neighbors, India remains a heavyweight in raw coconut and coconut oil production.

This regional concentration of production means that global supply is heavily dependent on the climate and economic stability of these countries. Weather events, like tropical storms or droughts, can have a ripple effect on global prices and availability.

Challenges and the Future of the Market

Despite its dominance, the Indonesian coconut industry faces several challenges. Many coconut palms are aging, and their yields are declining. Efforts to replant and rehabilitate plantations are underway but require significant time and capital. Furthermore, smallholder farmers, who make up a large portion of the workforce, often lack access to modern farming techniques and financing.

The global coconut milk market is projected to continue its strong growth trajectory. A 2025 report by Persistence Market Research estimated the market value at over $2 billion, with a projected compound annual growth rate (CAGR) of 8.7% through 2032. This growth is driven by several factors, including:

- Rising Health Consciousness: Consumers are increasingly seeking natural, functional food products.

- Expansion of Vegan and Plant-Based Diets: Coconut milk is a key dairy alternative in both home cooking and the food service industry.

- Global Popularity of Asian Cuisine: The demand for authentic ingredients like coconut milk in restaurants and home kitchens has surged.

The future of the coconut milk industry will likely depend on continued innovation in processing and sustainable farming practices. Companies are increasingly focused on ethical sourcing and supply chain transparency to meet consumer expectations. While the vast majority of coconut production is concentrated in a few countries, the economic and culinary impact of this tropical fruit is truly global.

Indonesia Cements Lead as World’s Largest Coconut Oil Producer, Outpacing Philippines