The purchase price of a property is often the headline figure in any real estate transaction, but it represents only a fraction of the total financial commitment. Prospective buyers frequently overlook the significant hidden costs of buying a home, a range of expenses that can strain budgets and cause financial distress long after the keys are handed over, according to housing finance experts.

8 Hidden Costs of Buying a Home

| Expense Category | Typical Cost Range |

| Closing Costs | 2% – 5% of Loan Amount |

| Annual Maintenance | 1% – 4% of Home Value |

| Private Mortgage Insurance (PMI) | 0.5% – 2% of Loan Annually |

The Full Financial Picture of Homeownership

For many, the dream of homeownership is a primary life goal. However, failing to account for a wide array of ancillary fees and ongoing homeownership expenses can turn that dream into a financial burden. Understanding these costs is critical for creating a sustainable budget.

“The list price is the cover of the book, not the whole story,” stated Dr. Elena Vance, a housing economist and senior fellow at the Urban Institute. “Buyers who focus solely on their monthly mortgage payment are often blindsided by thousands, or even tens of thousands, in other mandatory expenditures within the first year alone.”

Here are eight of the most common hidden costs that real estate professionals urge buyers to factor into their calculations.

1. The Bundle of Closing Costs

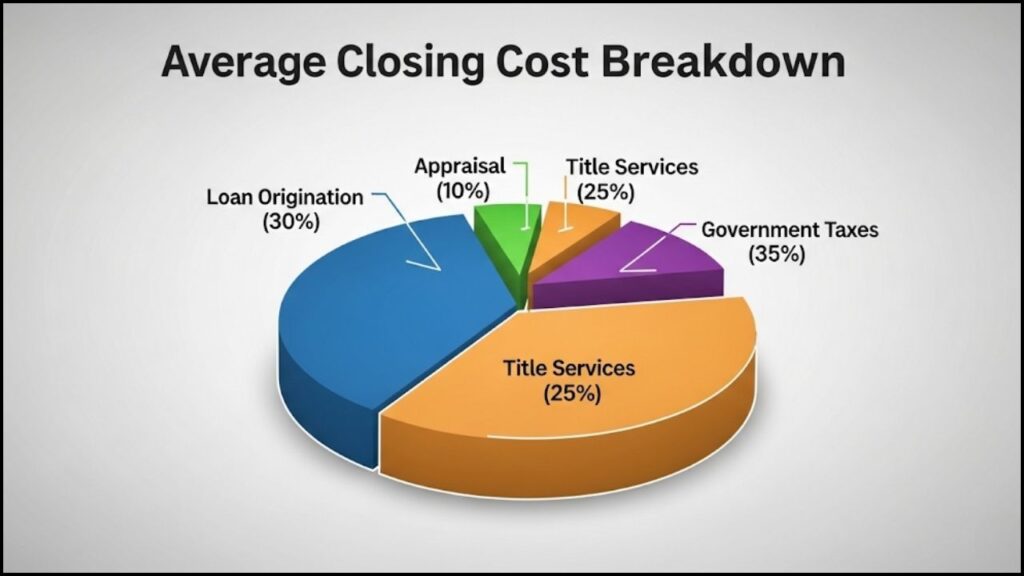

Perhaps the most significant upfront expense after the down payment, closing costs are a collection of fees required to finalize a real estate transaction. These are not a single charge but a suite of individual expenses that can include loan origination fees, appraisal fees, title insurance, underwriting fees, and attorney costs.

According to the Consumer Financial Protection Bureau (CFPB), a U.S. government agency, these costs typically range from 2% to 5% of the total loan amount. For a $400,000 home, this could mean an additional $8,000 to $20,000 in cash due at closing.

2. Recurring Property Taxes

Unlike a one-time fee, property taxes are a recurring, and often escalating, expense. These taxes are levied by local governments to fund public services like schools, infrastructure, and emergency services. They are typically held in an escrow account by the mortgage lender and paid on the homeowner’s behalf. Buyers often underestimate how much these taxes can increase over time as property values rise.

3. Homeowners Insurance

Lenders require homeowners insurance to protect their investment against damage from events like fire or natural disasters. Premiums vary widely based on the home’s location, age, construction type, and the owner’s claim history. In areas prone to floods or earthquakes, separate, specialized insurance policies are often necessary, adding another layer of cost.

4. Private Mortgage Insurance (PMI)

For buyers who make a down payment of less than 20% on a conventional loan, lenders typically require Private Mortgage Insurance (PMI). This insurance protects the lender, not the buyer, in case of default. According to data from financial services company Bankrate, PMI can cost between 0.5% and 2% of the original loan amount per year, adding a significant sum to the monthly mortgage payment until the homeowner reaches 20% equity.

5. Moving and Immediate Setup Costs

The expenses do not stop at the closing table. The physical act of moving can be costly, whether hiring a professional service or renting a truck. Beyond the move itself, new homeowners often face immediate costs for setting up utilities, changing locks, purchasing essential items like window coverings, or making small cosmetic changes.

6. Ongoing Maintenance and Unexpected Repairs

Experts often recommend budgeting 1% to 4% of a home’s value for annual maintenance and repairs. This fund covers everything from routine upkeep like gutter cleaning and pest control to major unexpected failures of systems like the HVAC, water heater, or roof.

“The 1% rule is a baseline, not a guarantee,” warned Mark Chen, a certified financial planner with over 20 years of experience. “For older homes or properties in harsh climates, a 3% or 4% budget is far more realistic to avoid debt when a major system fails.”

7. Homeowners Association (HOA) Fees

If the property is part of a planned community, condominium, or co-op, Homeowners Association (HOA) fees are often mandatory. These monthly or annual fees cover the maintenance of shared amenities and common areas, such as pools, landscaping, and security. HOA fees can increase over time and, in some cases, special assessments can be levied for large, unexpected community projects.

8. Initial Utility and Landscaping Costs

Finally, new homeowners are responsible for setting up and paying for all utilities, which may include electricity, gas, water, sewer, and trash removal. Some utility providers charge one-time setup or transfer fees. Additionally, the cost of basic landscaping equipment and ongoing yard maintenance can be a surprising new expense for those moving from a rental property.

Preparing a comprehensive budget that accounts for these often-overlooked expenses is crucial. Financial advisors recommend that potential buyers not only save for a down payment but also build a separate, robust fund specifically for these additional costs of entry and ownership.

Designers Warn Against 5 Tacky Home Upgrades That Devalue a property