In the global pursuit of natural health and wellness ingredients, one nation stands as the clear leader in the cultivation of a potent superfruit. Brazil is the country famous for producing the most acerolas, a small, cherry-like fruit renowned for its extraordinarily high vitamin C content. Fuelled by an ideal climate and advanced agricultural research, Brazil supplies over 70% of the world’s acerola, cementing its role as the critical source for this in-demand commodity.

The fruit, known scientifically as Malpighia emarginata, is native to the Americas but has found its commercial powerhouse in South America’s largest nation. While other tropical countries like Vietnam, India, and Mexico cultivate the fruit, their output remains modest compared to Brazil’s massive scale, which produces an estimated 33,000 to 35,000 metric tons annually. This production satisfies both a robust domestic market and a growing international demand for acerola in powders, juices, and dietary supplements.

The State of Acerola Production

| Key Fact | Detail / Statistic |

| Top Producer | Brazil accounts for over 70% of the global acerola supply. |

| Annual Output | Brazil produces between 33,000 and 35,000 metric tons per year. |

| Nutritional Edge | Acerola contains 50-100 times more Vitamin C per 100g than an orange or lemon. |

| Economic Value | The global acerola extract market was valued at over $20 billion in 2024. |

Why Brazil Dominates the Acerola Market

Brazil’s status as the leading country famous for producing the most acerolas is no accident. It is the result of a combination of favorable environmental conditions, significant investment in agricultural science, and a well-developed processing industry.

Ideal Climate and Geography

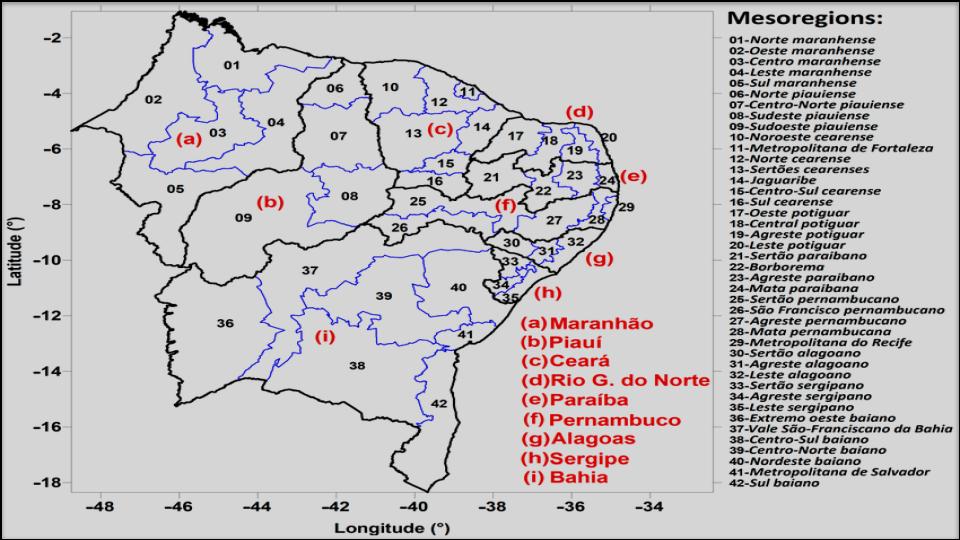

The acerola plant thrives in the tropical conditions found across Brazil, particularly in its Northeast region. States such as Pernambuco, Bahia, and Ceará offer the perfect mix of abundant sunshine, consistent rainfall, and fertile, well-drained soils. These conditions allow for multiple harvest cycles throughout the year, ensuring a steady supply.

“The climatic conditions in Brazil’s northeast are optimal for acerola cultivation,” said Dr. João Silva, an agronomist with the Brazilian Agricultural Research Corporation (Embrapa), a state-owned research entity. “The plant is well-adapted to our environment, which allows for high yields and excellent fruit quality.”

Advanced Agricultural Research

Institutions like Embrapa have been instrumental in solidifying Brazil’s market position. For decades, it has invested in developing high-yield, disease-resistant acerola varieties that are also exceptionally rich in vitamin C. This research has not only boosted acerola production volumes, with modern farms yielding up to 50 tons per hectare, but has also preserved the fruit’s genetic diversity. According to a report from the organization, Brazil is a guardian of over 90% of the world’s acerola varieties.

The Superfruit’s Journey from Farm to Consumer

The vast majority of Brazil acerola is not sold as fresh fruit on the international market. Due to its highly perishable nature—the fruit lasts only two to three days after being harvested—an efficient processing industry is essential.

Most acerola farms are located near processing plants that can quickly convert the fruit into more stable forms. These products include:

- Frozen Pulp: A popular base for juices and smoothies.

- Juice Concentrate: Used in the beverage industry.

- Dehydrated Powder and Extracts: The most common form for export, used widely in dietary supplements, functional foods, and cosmetics.

“The logistical chain is critical for acerola,” explained a spokesperson for a major Brazilian food exporter in a recent industry publication. “Our ability to process the fruit within hours of harvest is key to preserving the high vitamin C content that our global customers demand.”

The United States, Germany, Japan, and France are among the top export markets for these processed acerola products, driven by rising consumer awareness of natural health ingredients.

Challenges and Future Outlook

Despite its strong position, the Brazilian acerola production sector faces challenges, including climate variability and competition from synthetic vitamin C, which can be cheaper to produce. However, the global trend toward natural and plant-based ingredients continues to fuel demand.

Market analysts project the global acerola extract market to continue its robust growth, with a compound annual growth rate (CAGR) of over 8%, according to a 2024 report by Global Market Insights. This growth is linked to acerola’s expanding use not only in supplements but also as a natural preservative in the meat and baking industries due to its antioxidant properties.

As global consumers increasingly prioritize natural sources of nutrition, Brazil’s role as the primary supplier of this potent superfruit appears secure. The country’s deep expertise and established infrastructure provide a strong foundation for meeting the world’s growing appetite for acerola.

Read More

The Surprising Country That Produces the Most Cherries & How to Grow Your Own