The United States stands as the unequivocal leader in global cheese production, consistently outranking traditionally cheese-centric nations such as France, Germany, and Italy. This robust output is driven by substantial domestic demand, innovative production techniques, and a highly efficient dairy sector. The U.S. produced an impressive 6.7 million metric tons of cheese in 2021, a figure that underscores its commanding position in the international dairy market.

A Production Powerhouse: U.S. Output Figures

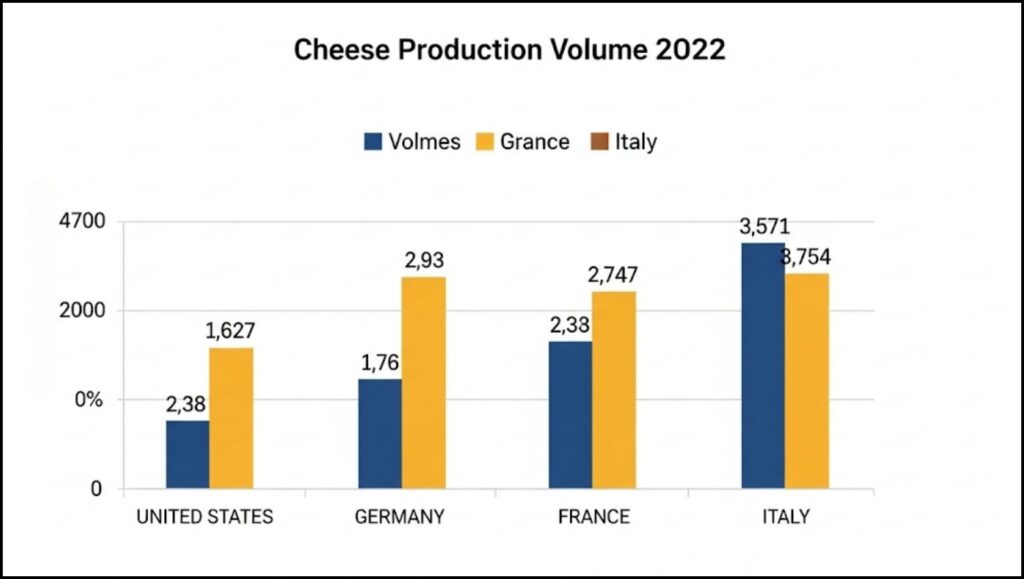

While countries like France and Italy are renowned for their artisanal cheese heritage and diverse varieties, the United States has focused on large-scale, efficient production to meet its significant internal consumption. According to Statista data for 2022, the U.S. produced 6.38 million metric tons of cheese, far exceeding Germany’s 2.64 million metric tons and Italy’s 1.2 million metric tons. This demonstrates the sheer volume generated by the American dairy industry.

The sheer scale of U.S. cheese production is further highlighted by state-level contributions. Wisconsin, often dubbed “America’s Dairyland,” is the largest cheese-producing state, accounting for approximately 25% of the national output. The state produces about 3.5 billion pounds of cheese annually, converting 90% of its milk into various cheese types. California follows as the second-largest producer, contributing around 2.4 billion pounds each year.

Factors Fueling U.S. Dominance

Several factors contribute to the United States’ leading role in global cheese production:

- High Domestic Consumption: Americans are significant consumers of cheese. In 2023, per capita cheese consumption in the U.S. exceeded 42 pounds, according to the U.S. Department of Agriculture (USDA). This strong internal market provides a stable base for continuous production. The prevalence of cheese in popular American diets, from pizzas and sandwiches to various casseroles, sustains this demand.

- Industrial Scale and Technology: The U.S. dairy industry benefits from highly industrialized farming practices and advanced processing technologies. These enable efficient, high-volume production, driving down costs and maximizing output. Investments in upgraded and expanded production facilities are ongoing, leveraging an abundance of raw materials.

- Variety and Innovation: While traditional European cheeses dominate in variety, the U.S. industry is increasingly innovating, particularly in deli specialty cheeses. Sales of these varieties have seen an 8% increase in both volume and dollar terms in 2025, with Hispanic and Italian cheese types leading this growth, according to Circana sales data. This shift indicates a growing consumer desire for diverse and elevated cheese experiences beyond conventional American cheese, which has seen a nearly 5% decline in sales year-to-date in 2025.

- Market Adaptability: The U.S. cheese market has shown adaptability to evolving consumer preferences. For instance, while processed American cheese sales are down, manufacturers are responding with new formulations, including natural American cheese lines and convenient formats like 8oz bricks for easy melting.

European Contributions and Global Context

While the U.S. leads in total volume, Europe remains a crucial hub for cheese manufacturing and consumption, particularly known for its diverse artisanal and traditional cheeses. Germany, France, and Italy are consistently among the top global producers after the U.S. In 2023, Germany produced 2.4 million tonnes, France 1.9 million tonnes, and Italy 1.3 million tonnes, according to Eurostat.

The European Union’s cheese production is projected to increase by nearly 1% in 2024, reaching approximately 10.5 million tons. This growth is driven by robust domestic consumption and consistent export demand, particularly for hard cheeses like Grana Padano and Parmigiano Reggiano. Germany, France, Italy, the Netherlands, and Poland collectively account for nearly three-quarters of the EU’s total cheese output.

Globally, cheese production is anticipated to reach 25.2 million metric tons by 2026, growing at an annual rate of 0.9% from 23.9 million metric tons in 2021, as per ReportLinker. This upward trend reflects increasing global demand, particularly in emerging markets where Western dietary habits are gaining traction.

Export Dynamics and Trade Flows

Despite its massive production, the United States is not the top cheese exporter. European nations, particularly Germany, the Netherlands, France, and Italy, lead in cheese exports. In 2023, Germany was the top global cheese and curd exporter, valued at $3.67 billion, followed by the Netherlands and France, according to ReportLinker. The U.S. ranks fifth in global cheese exports, having recently expanded its presence in Asian markets like Mexico, South Korea, Japan, Australia, and Canada, as reported by the USDA.

Challenges and Future Outlook

The global dairy industry faces various challenges, including fluctuating raw milk prices, high operational costs, and the increasing impact of climate change. A recent study published in Science Advances found that extreme heat can reduce milk production by up to 10%, even with cooling technologies in place. This poses a significant concern for major dairy-producing regions worldwide, including the U.S. and parts of Europe, underscoring the need for sustainable practices and climate resilience in dairy farming.

Looking ahead, the global cheese market is projected to grow from USD 199.14 billion in 2025 to USD 283.10 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.15%, according to Fortune Business Insights. This growth is driven by rising consumer demand for high-quality dairy products, advancements in processing technology, and an increasing focus on sustainability. The market will also see continued innovation in artisanal, functional, and plant-based cheese alternatives, catering to evolving dietary preferences and health consciousness among consumers.

The dominance of the United States in global cheese production highlights a sophisticated industry capable of meeting vast consumer demand, even as it navigates challenges and adapts to a dynamic global food landscape. The ongoing trends suggest a future where efficiency, innovation, and sustainability will increasingly shape the industry’s trajectory.

Unpeeling the Truth: Which Country is Famous for Producing the Most Bananas?