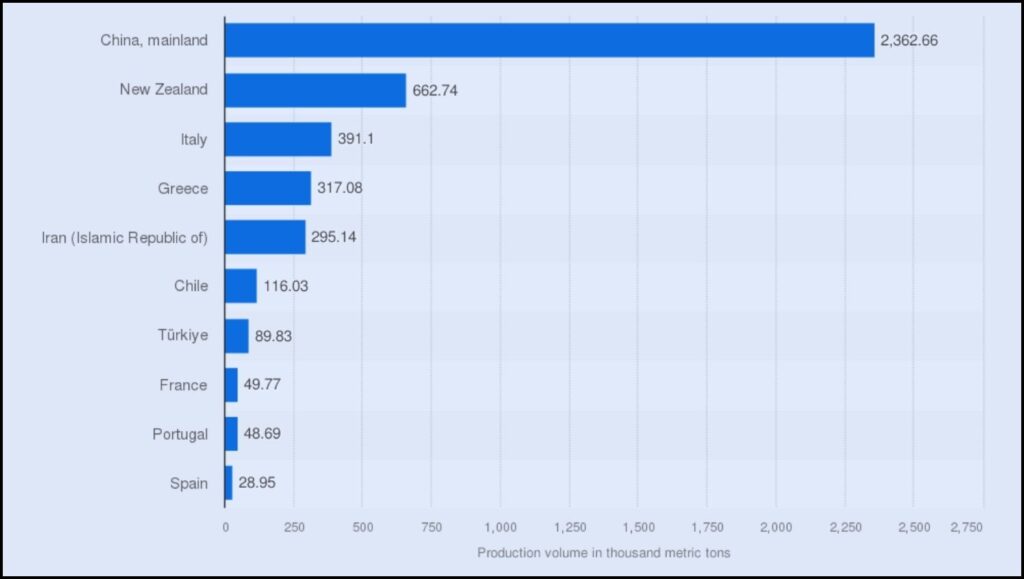

Kiwifruit, once a niche fruit primarily cultivated in China, has ascended to global prominence, becoming a significant agricultural commodity. As of 2025, China stands as the undisputed leader in kiwi production, far surpassing other traditional powerhouses like New Zealand and Italy. This shift reflects evolving agricultural strategies, consumer demand, and the continuous development of new kiwi varieties worldwide.

China’s Dominance in Kiwi Production

China, the native home of the kiwifruit (historically known as the Chinese gooseberry), has dramatically increased its output, accounting for over 50% of the world’s total production. In 2023, China produced approximately 2.4 million metric tons of kiwi, solidifying its position as the largest kiwi-producing country. Key growing regions within China include Shaanxi, Sichuan, and Henan provinces, where fertile soils and suitable climates support extensive cultivation.

This remarkable growth is attributed to strategic investments in agricultural technology, including greenhouse farming, and dedicated research and development into domestic cultivars. The Wuhan Botanical Garden of the Chinese Academy of Sciences (CAS), for instance, houses the world’s largest kiwifruit gene bank, actively involved in breeding new varieties like ‘Donghong’, ‘Jinyan’, and ‘Jintao’. While China’s production is substantial, a large portion is consumed domestically, with a relatively small percentage allocated for export.

New Zealand: A Global Export Powerhouse

Despite China’s lead in volume, New Zealand remains a critical player, particularly in the global export market. In 2023, New Zealand produced around 662,744 metric tons of kiwifruit, making it the second-largest producer. However, it holds the top spot as the world’s leading exporter, capturing a significant 41.7% value share of the global market.

New Zealand’s success is largely driven by Zespri International Ltd., a marketing cooperative that has built a strong global brand for its green ‘Hayward’ and popular golden ‘SunGold’ kiwi varieties. Zespri’s meticulous quality control, innovative branding, and well-established supply chains have allowed New Zealand to dominate high-value markets, particularly in Asia, Europe, and North America. The Bay of Plenty region is the heart of New Zealand’s kiwi farming.

Italy and Greece: Europe’s Kiwi Hubs

Italy, historically a major kiwifruit exporter, now ranks as the third-largest global producer, with approximately 391,100 metric tons in 2023. Leveraging its extensive grape-growing infrastructure and techniques from the 1980s, Italy quickly became a significant cultivator. Regions like Lazio, Emilia-Romagna, and Piedmont are key growing areas. Italian producers primarily cultivate the ‘Hayward’ variety and have also developed yellow-fleshed cultivars such as ‘Soreli’ and ‘Dorì’. Italy’s proximity to the European market offers a significant logistical advantage, and its growing season complements that of Southern Hemisphere producers, reducing direct market competition.

Greece has emerged as a formidable competitor in recent years, securing the fourth position in global kiwi production with roughly 317,080 metric tons in 2023. Favorable Mediterranean weather in regions like Central Macedonia and Thessaly, coupled with increased investments in modern farming, have boosted Greek output. Greece primarily exports its ‘Hayward’ green kiwi to other European countries, including Germany and France.

Other Significant Producers

Iran is another notable country in kiwi production, ranking fifth globally with around 295,142 metric tons in 2023. Kiwi farms are predominantly located near the Caspian Sea, particularly in Mazandaran province. While a significant portion is consumed domestically, Iran’s kiwi exports to neighboring markets have seen an increase.

Chile also plays a role in the global kiwi market, producing approximately 116,029 metric tons in 2023. As a Southern Hemisphere producer, Chile’s season counter-balances those in the Northern Hemisphere, contributing to a consistent global supply throughout the year.

Market Dynamics and Challenges

The global kiwi fruit market is projected to continue its growth, driven by increasing consumer awareness of the fruit’s health benefits, including high vitamin C content and fiber. The rising popularity of plant-based diets and the introduction of new, sweeter varieties like gold kiwifruit also contribute to this demand. The market was valued at approximately $1.5 billion in 2022 and is expected to reach $2.1 billion by 2030, according to Mordor Intelligence.

However, the industry faces several challenges. Climate change poses a threat to yields due to altered weather patterns, while pest and disease outbreaks, such as Pseudomonas syringae pv. actinidiae (PSA), can devastate crops. Additionally, logistical bottlenecks, rising shipping costs, and the relatively short shelf life of ripened kiwi fruit necessitate advanced post-harvest management and robust supply chains.

Global trade agreements and innovative breeding programs are crucial for the continued expansion and stability of the kiwi market. Countries investing in research for disease resistance and improved varieties are likely to maintain or strengthen their market positions, catering to the evolving demands of a global consumer base increasingly focused on health and diverse fruit options.

Who is the World’s Largest Horned Melon Producer? The Answer is More Complex Than It Appears