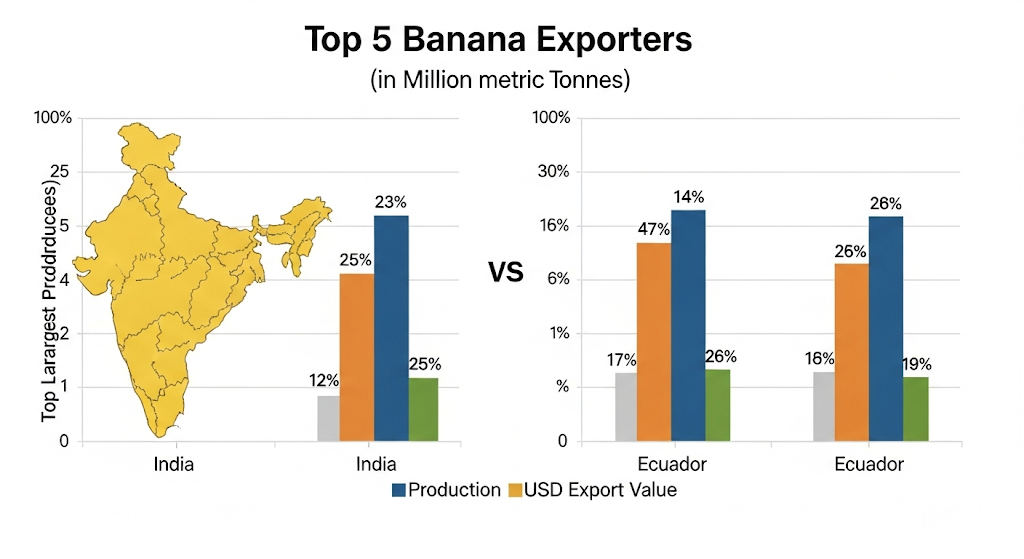

India holds the undisputed title of the largest banana producer globally, accounting for approximately 26% of the world’s total output. With annual production exceeding 33 million metric tonnes, India’s yield is nearly triple that of China, the second-largest producer. However, this massive production primarily serves India’s substantial domestic market, creating a significant divergence between global production leaders and the main players in the international export trade.

The banana is one of the most consumed fruits worldwide and a critical crop for food security and economic stability in many developing nations. According to data from the Food and Agriculture Organization (FAO) of the United Nations, bananas are grown in over 130 countries across tropical and subtropical regions.

While India leads in sheer volume, the global banana trade is dominated by Ecuador. Ecuador produces significantly less than India—around 6.6 million metric tonnes—but is the world’s largest exporter, supplying key markets in the European Union and the United States.

Key Production Statistics

| Rank | Country | Estimated Annual Production (Million Metric Tonnes) | Role in Global Market |

| 1 | India | 33.0 | Largest Producer; Primarily domestic consumption. |

| 2 | China | 12.0 | Major producer; High domestic consumption. |

| 3 | Indonesia | 8.9 | Significant producer; Mix of domestic and export. |

| 4 | Brazil | 6.8 | Major producer; Strong domestic market. |

| 5 | Ecuador | 6.6 | Largest global exporter. |

India’s Role as the Largest Banana Producer

India’s dominance in banana cultivation is supported by favorable tropical climates, vast agricultural land, and high domestic demand. The fruit holds significant cultural and dietary importance across the country. States such as Tamil Nadu, Andhra Pradesh, and Maharashtra are the leading contributors to the nation’s total output.

The banana industry in India is a cornerstone of the agricultural economy, providing livelihoods for millions of smallholder farmers. Bananas are the second-largest fruit crop in the country, following mangoes. The adaptability of banana cultivation to various regional climates allows for year-round production in many parts of the country.

Despite its massive production scale, India exports only a small fraction of its bananas. High domestic consumption rates mean that the vast majority of the 33 million metric tonnes produced annually remain within the country. In recent years, the Indian government has indicated intentions to increase export infrastructure, targeting markets in the Middle East and Southeast Asia, but domestic demand remains the primary driver of the industry.

The Dynamics of the Global Banana Trade

The structure of the international banana market contrasts sharply with production statistics. While production is highest in Asia, the export market is heavily reliant on Latin American countries.

Ecuador Leads Exports

Ecuador remains the dominant force in the global banana trade. In 2023, Ecuador’s banana exports were valued at approximately $3.6 to $3.78 billion, according to international trade data. The Ecuadorian banana industry is highly organized and structured specifically for export efficiency, primarily shipping the Cavendish variety to North America and Europe.

Following Ecuador, the Philippines is the second-largest exporter and the primary supplier to Asian markets, including Japan and China. Costa Rica, Colombia, and Guatemala are also critical players in the export market. These nations rely heavily on banana exports as a significant source of foreign income and rural employment.

The Dominance of the Cavendish

The international banana trade is characterized by a heavy reliance on a single variety: the Cavendish. The FAO estimates that the Cavendish accounts for just under half of global banana production but represents nearly all bananas traded internationally.

This reliance on a single genetic variety, often grown in large-scale monoculture plantations, makes the global supply chain highly efficient but also extremely vulnerable. Monoculture farming practices often require significant agrochemical inputs and increase the risk of widespread crop failure due to disease.

Challenges Facing the Banana Industry

The global banana industry faces significant threats that could disrupt supply chains, impacting both the largest producers and the major exporters. These challenges include climate change, rising operational costs, and, most critically, virulent plant diseases.

The Threat of Fusarium Wilt TR4

The most pressing danger to the global banana supply is Fusarium Wilt Tropical Race 4 (TR4), often referred to as Panama disease. TR4 is a soil-borne fungus that attacks the root system of the banana plant and is lethal. There is currently no viable treatment; once a plantation is infected, the soil remains contaminated for decades.

TR4 poses an existential threat to the Cavendish banana, which is highly susceptible to the fungus. The disease has spread from Asia and Africa, and in 2019, it was detected in Latin America, the heart of the export industry.

“Once fusarium wilt is in the plantation you cannot get rid of it, there is no control method, you basically need to burn down the plantation and move production somewhere else,” Pascal Liu, a Senior Economist at the FAO, noted in a March 2024 report.

The reliance of global exports on the TR4-susceptible Cavendish means that the spread of the disease could have devastating economic consequences for exporting nations and lead to shortages in importing countries.

Economic and Environmental Pressures

In addition to disease, the industry is grappling with economic volatility. Producers have faced rising costs for essential inputs such as fertilizer and fuel. Furthermore, geopolitical tensions and climate-related issues, such as droughts affecting the Panama Canal, have increased transportation costs and complicated logistics.

Climate change also presents ongoing challenges. Increased frequency of extreme weather events, including hurricanes and droughts, particularly affects production in Latin America and Asia. These events disrupt supply and place financial strain on producers who must also contend with market pressures from large retail chains in importing countries pushing for lower prices.

Future Outlook

While India is expected to maintain its position as the largest banana producer, the stability of the global market hinges on addressing the threat of TR4. International research efforts are focused on developing disease-resistant banana varieties to diversify the market away from the vulnerable Cavendish. Ensuring the long-term viability of the banana industry will require sustainable cultivation practices and adaptation to both biological and climatic threats.

Mexico Solidifies Lead as World’s Top Avocado Exporter Amidst Growing Global Demand