Indonesia has solidified its position as the world’s largest coconut oil producer, outpacing its long-standing rival, the Philippines, amid shifting global demand and significant challenges facing the industry. This dominance in the multibillion-dollar market highlights the crop’s immense economic importance for Southeast Asia, even as climate change and market volatility pose growing threats to millions of smallholder farmers.

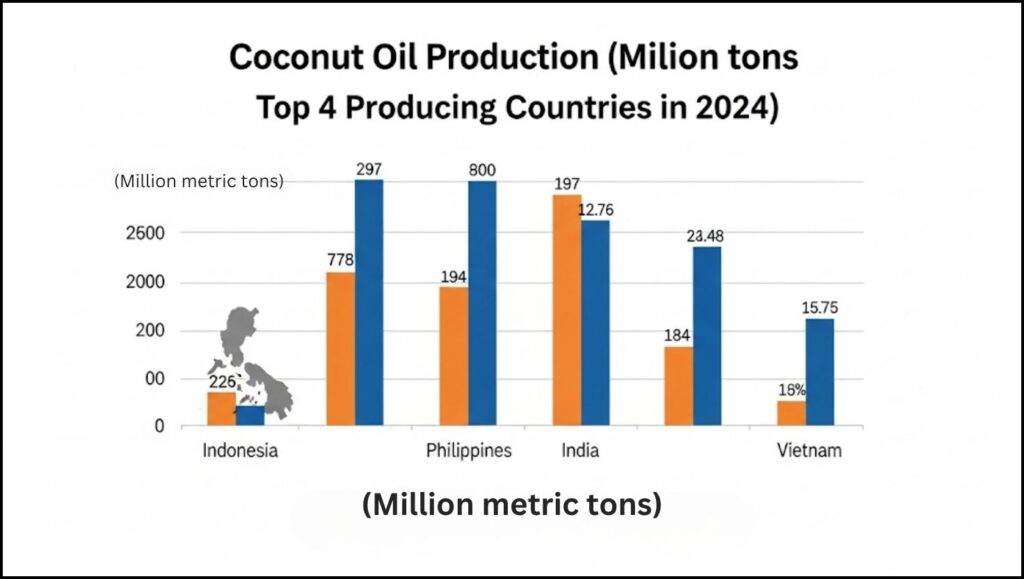

According to the latest data from the United States Department of Agriculture (USDA), Indonesia is forecast to produce 2.95 million metric tons of coconut oil for the 2024/2025 market year. The Philippines follows as the second-largest producer, with an output of 1.48 million metric tons. This gap underscores a trend that has been developing for several years, driven by a combination of production scale, government policy, and agricultural challenges.

Key Insights: The Global Coconut Oil Landscape

| Key Fact | Detail/Statistic |

| Top Producer | Indonesia (2.95 million metric tons projected for 2024/25) |

| Second Largest Producer | Philippines (1.48 million metric tons projected for 2024/25) |

| Key Export Markets | European Union, United States, China |

| Primary Product Types | Crude Coconut Oil & Virgin Coconut Oil |

Indonesia’s Path to Dominance

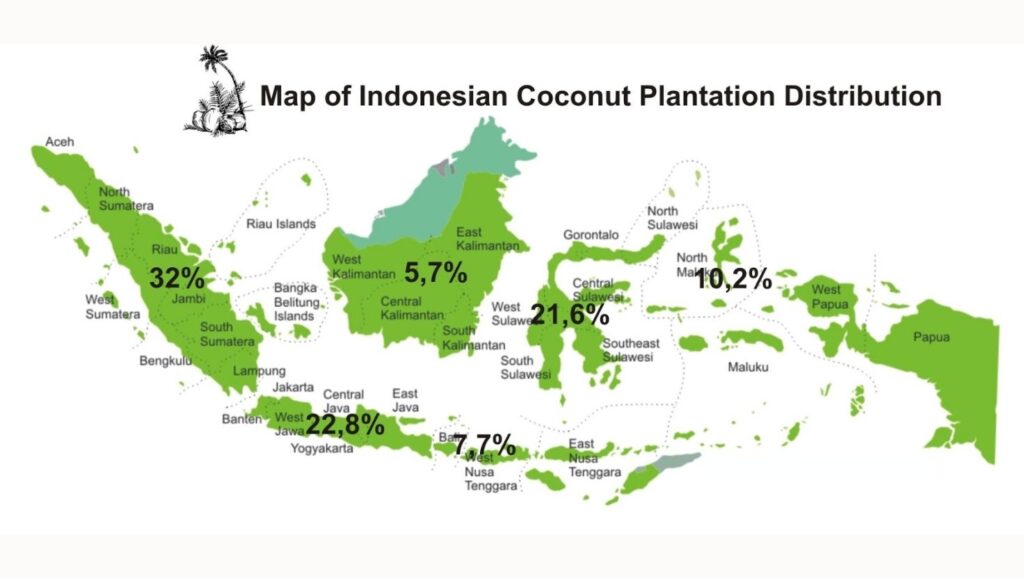

Indonesia’s leadership in coconut production is largely a function of its vast land area dedicated to the crop. The nation has over 3.3 million hectares of coconut plantations, the largest in the world, primarily managed by smallholder farmers. The Indonesian government has also implemented programs aimed at boosting downstream industries, encouraging more domestic processing of coconuts into higher-value products like oil rather than exporting raw copra (dried coconut kernel).

“Indonesia’s strategic advantage lies in its sheer scale and an integrated approach to the coconut value chain,” said an analyst from the Asian and Pacific Coconut Community (APCC), an intergovernmental organization that promotes coconut development. “Investment in refining capacity allows the country to meet diverse global demands, from crude oil for industrial use to refined oil for food products.”

This strategy has enabled Indonesia to capitalize on the steady global demand for coconut oil, which is a key ingredient in everything from cosmetics and soaps to confectionery and cooking oils.

The Philippines: A Competitor Facing Headwinds

For decades, the Philippines was the undisputed leader in the coconut oil trade. However, the country’s industry has faced significant hurdles that have hindered its growth. A primary challenge is the aging of its coconut trees, many of which were planted in the post-World War II era and are now past their peak productivity.

Furthermore, the Philippine archipelago is highly vulnerable to extreme weather events. “Each year, powerful typhoons can wipe out hundreds of thousands of trees, devastating farming communities and disrupting the supply chain for months, if not years,” stated a 2024 report from the Philippine Coconut Authority (PCA). These climate-related shocks, combined with issues like pest infestations and logistical challenges, have constrained production capacity.

Despite these issues, the Philippines remains a critical player, particularly in the U.S. and European markets, and is a leading supplier of high-quality coconut oil.

The Shifting Dynamics of the Global Coconut Market

The competition between Indonesia and the Philippines is unfolding against the backdrop of a dynamic global coconut market. A key trend is the growing distinction between conventional crude coconut oil and premium virgin coconut oil (VCO).

The Rise of Virgin Coconut Oil

VCO, which is extracted from fresh coconut milk or meat without the use of chemical refining, has gained popularity in health-conscious markets in North America and Europe. It commands a significantly higher price than its conventional counterpart. While it represents a smaller portion of the overall market, it offers a lucrative opportunity for producers.

Countries like Sri Lanka and Vietnam have successfully carved out niches in the premium VCO market. Both the Philippines and Indonesia are also working to increase their VCO output to capture more value from their coconut resources. “The future is not just about volume, but about value,” explained Dr. Elena Garcia, an agricultural trade expert. “The ability to meet stringent quality standards for VCO and organic certifications is becoming a key competitive advantage.”

Economic and Environmental Outlook

The future of the global coconut market depends heavily on addressing sustainability and the welfare of its farmers. The vast majority of the world’s coconuts are grown by smallholders who often live below the poverty line, making them vulnerable to price volatility and the impacts of climate change.

Industry experts and international bodies emphasize the need for greater investment in research for climate-resilient coconut varieties, improved farming practices, and fair-trade initiatives. Replanting aging trees and diversifying farmer income are seen as critical steps to ensure the long-term viability of the industry.

As both Indonesia and the Philippines navigate these challenges, their ongoing competition will continue to shape the global supply of this versatile tropical oil. The focus is slowly shifting from a pure race for volume to a more complex strategy involving value addition, sustainability, and resilience.

The Global Guava Trade: How Mexico Became the World’s Largest Guava Exporter