While the global demand for plant-based alternatives to dairy continues to surge, China has firmly established itself as the world’s largest soy milk producer. This leadership is not a recent development but is rooted in centuries of cultural tradition, now amplified by modern industrial scale and a vast consumer base, according to industry analyses and government data.

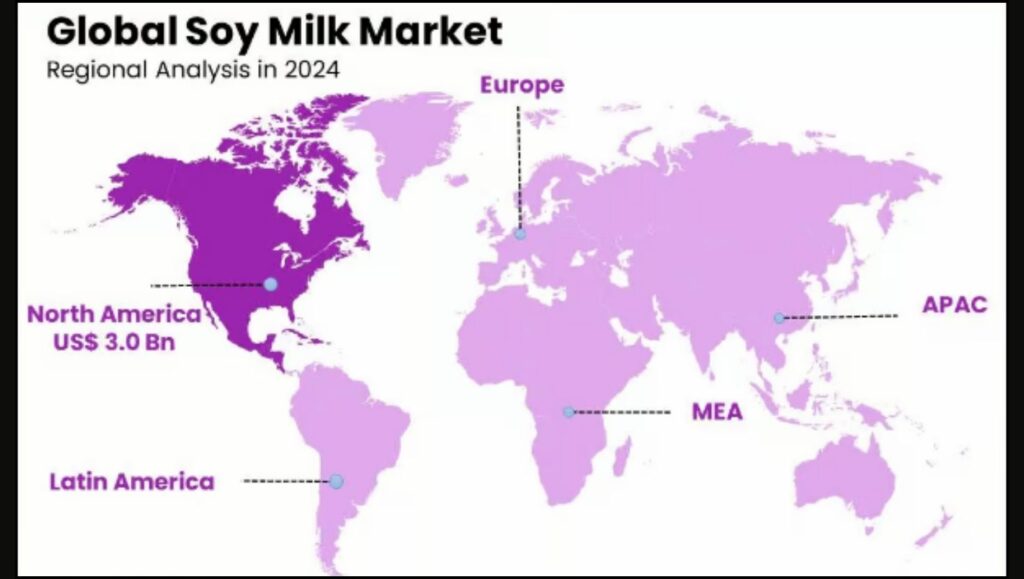

The global soy milk market was valued at approximately $10.1 billion in 2023 and is projected to continue its growth, as reported by Grand View Research. China’s production accounts for a substantial share of this market, dwarfing that of other nations. The country’s unique position is a blend of historical consumption patterns and strategic industrial development that caters to both traditional tastes and new health-conscious consumers.

China’s Deep-Rooted Dominance

Soy milk, known as doujiang (豆浆) in Mandarin, has been a breakfast staple in China for centuries. This long-standing cultural acceptance provides a stable and massive domestic market that is unmatched globally.

“Unlike in Western markets where soy milk was introduced as a niche health product, in China it is a mainstream beverage consumed by all demographics,” said Dr. Liu Wei, a food historian at Peking University. “This foundational demand gives Chinese producers an enormous advantage in scale.”

Major Chinese companies like Dali Foods Group and Hong Kong-based Vitasoy have capitalized on this, expanding from traditional street-side vendors to mass-market producers. Their products range from simple, fresh soy milk to shelf-stable, flavored versions available in supermarkets nationwide. According to a 2024 market report from the China National Food Industry Association, domestic production exceeded 12 million metric tons last year, driven by both at-home consumption and a thriving food service sector.

The Global Landscape and Shifting Trends

While China leads in production, the plant-based milk market is a dynamic global industry. The United States, Europe, and other parts of Asia, particularly Japan and Thailand, are also significant producers and consumers. However, the drivers in these markets often differ. In North America and Europe, the growth of soy milk and other plant-based alternatives is heavily influenced by global food trends such as veganism, concerns over lactose intolerance, and environmental sustainability.

“In the U.S. and E.U., the consumer is often making an active choice to switch from dairy for ethical or environmental reasons,” explained Caroline Bain, Chief Commodities Economist at Capital Economics. “This has led to intense competition, with oat and almond milk capturing significant market share from soy in recent years due to consumer preferences for taste and texture.”

This competition is a key challenge for soy milk producers outside of China. Data from the Plant Based Foods Association shows that while the overall plant-based milk category is growing in the U.S., oat milk sales have seen the fastest growth, surpassing soy milk in revenue.

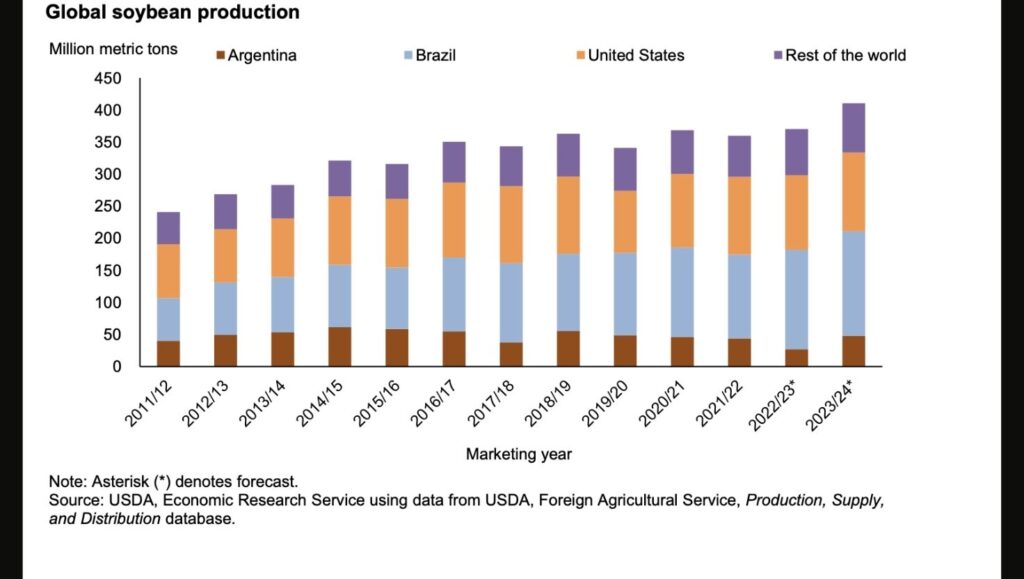

The Critical Role of Soybean Production

The soy milk industry is intrinsically linked to soybean production. The world’s top soybean producers are the United States, Brazil, and Argentina, which together account for over 80% of the global supply, according to the U.S. Department of Agriculture (USDA). This creates a global supply chain where raw soybeans, a major commodity, are shipped to countries like China for processing. While China is a massive producer of soy milk, it is also the world’s largest importer of soybeans to meet demand for animal feed and food products.

This reliance on imports presents vulnerabilities, including exposure to international trade disputes and scrutiny over the environmental impact of soybean farming. Deforestation in the Amazon, linked to clearing land for soy cultivation, has led to calls for more sustainable and traceable supply chains, a pressure point for global food companies that source from the region.

Future Outlook: Innovation and Competition

Looking ahead, the future of the global soy milk market will be defined by innovation and its ability to compete with a growing array of plant-based milks. Producers are investing in new formulations to improve taste and texture, as well as fortifying products with vitamins and minerals to appeal to health-conscious consumers.

In China, the market is expected to remain robust, buoyed by its cultural foundation. Internationally, however, soy milk’s position is less secure. Its success will depend on its ability to navigate consumer perceptions and effectively market its strong nutritional profile, which is often higher in protein than many of its plant-based rivals.

“Soy milk is the original plant-based milk and it’s not going away,” Bain concluded in a recent analysis. “But its path forward, especially in Western markets, involves embracing innovation to stay relevant in an increasingly crowded aisle.”