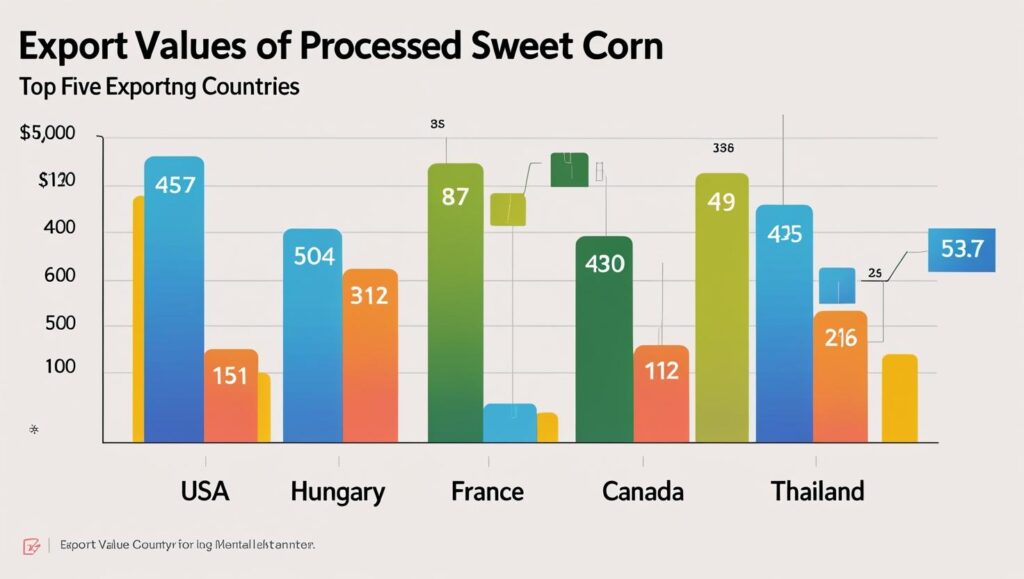

The United States continues to lead the global trade in sweet corn, solidifying its long-held status as the largest sweet corn exporter. Driven by vast agricultural infrastructure and high-tech processing capabilities, the U.S. supplies a significant portion of the world’s canned and frozen sweet corn, feeding a consistent international demand, particularly in Asia and Europe.

Key Insights: Global Sweet Corn Trade

| Key Fact | Detail / Statistic |

| Top Exporter (Value) | United States, with exports of processed sweet corn valued at over $360 million annually. |

| Primary Export Form | Frozen and canned varieties dominate international trade over fresh sweet corn. |

| Top Importing Nations | Japan, Taiwan, and Mexico are the largest importers of U.S. sweet corn. |

| Key Competitors | Hungary leads in fresh exports to the EU, with France, Canada, and Thailand also being major players. |

America’s Dominance in a Multi-Billion Dollar Market

In the complex global landscape of agricultural trade, the United States holds a firm grip on a seemingly simple commodity: sweet corn. With advanced farming technology, extensive production scale, and a sophisticated logistics network, the U.S. has consistently ranked as the largest sweet corn exporter, a title it has maintained for years. The nation’s dominance is most pronounced in the processed sweet corn sector, which includes frozen and canned goods that boast a longer shelf life, making them ideal for international shipping.

According to data from the International Trade Centre (ITC), a joint agency of the World Trade Organization and the United Nations, the U.S. exports of prepared or preserved sweet corn regularly exceed $360 million in value. This figure far surpasses its closest competitors, underscoring the scale of its operation.

“The U.S. advantage is a combination of ideal growing conditions in states like Minnesota, Wisconsin, and Washington, coupled with significant private and public investment in agricultural research and development,” said Dr. Michael Reed, an agricultural economist at the University of Kentucky. “This allows for high yields, consistent quality, and efficient supply chains that global buyers rely on.”

The Anatomy of U.S. Sweet Corn Exports

The majority of American sweet corn destined for international markets is not the fresh cob-on-the-ear variety found at local summer barbecues. Instead, the export powerhouse lies in value-added products.

Frozen and Canned Varieties Lead the Way

Frozen sweet corn represents the largest share of U.S. exports. The process of blanching and flash-freezing, often within hours of harvesting, preserves the vegetable’s sweetness and nutritional value. This allows it to be transported across oceans without significant degradation in quality. Canned sweet corn follows closely, offering even greater shelf stability for consumers and food service industries worldwide.

Data from the U.S. Department of Agriculture (USDA) Economic Research Service highlights that key markets for these products include Japan, which has long been the top importer of American sweet corn, along with Taiwan, Mexico, and various European Union nations. In Japan, U.S. frozen sweet corn is a staple ingredient in everything from salads to ramen toppings, a testament to decades of established trade relationships and marketing efforts.

The Global Competitive Landscape

While the U.S. is the overall leader, it does not stand unchallenged. The global sweet corn market is diverse, with other nations carving out significant niches.

Hungary: The Fresh Market Leader in Europe

Hungary has established itself as a formidable force in the fresh sweet corn market, particularly within the European Union. Its geographical proximity and ability to quickly transport fresh produce give it a competitive edge over the U.S. in serving European consumers. According to the Food and Agriculture Organization (FAO) of the United Nations, Hungary is consistently one of the top exporters by volume when focusing solely on fresh or chilled sweet corn.

“For fresh produce, speed to market is everything,” explains a recent report from Rabobank, a Dutch multinational banking and financial services company specializing in food and agriculture. “Hungarian producers can harvest and have their sweet corn on a supermarket shelf in Germany or Poland within 48 hours. That’s a logistical advantage that is difficult for transatlantic suppliers to overcome.”

Other notable exporters include France, a major producer within the EU, and Canada, which benefits from its trade relationship with the United States. In recent years, countries like Thailand and Mexico have also increased their sweet corn production and export capacity, adding new dynamics to the global market.

Challenges and Future Outlook

Despite its strong position, the U.S. sweet corn industry faces several challenges. Shifting consumer preferences towards non-GMO and organic products present both an opportunity and a hurdle. While the U.S. is increasing production in these areas, certification and segregation of crops require additional investment.

Furthermore, global climate patterns and trade policies remain significant variables. Droughts in key growing regions can impact yields and prices, while international trade disputes can disrupt established supply chains. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), for example, has altered trade flows, offering advantages to member countries like Canada and Mexico in the Japanese market.

Looking ahead, the demand for convenient, high-quality food products is expected to keep the global market for processed sweet corn robust. “The enduring popularity of sweet corn as a versatile ingredient in households and restaurants worldwide suggests a stable future,” said a trade analyst from IHS Markit in a recent market brief. “The key for the U.S. will be to adapt to changing consumer demands and navigate the evolving landscape of international trade agreements to maintain its position as the largest sweet corn exporter.”

Jamaica Solidifies Its Position as the World’s Leading Ackee Producer