New Zealand consistently holds the top position as the Leader in Dairy Ingredient in the world, particularly for dry whole milk powder. This dominance is driven by an efficient, export-oriented dairy industry that leverages favorable agricultural conditions and advanced processing capabilities. The nation’s significant contribution to the global supply of milk powder underscores its pivotal role in international food markets.

New Zealand’s Production Prowess

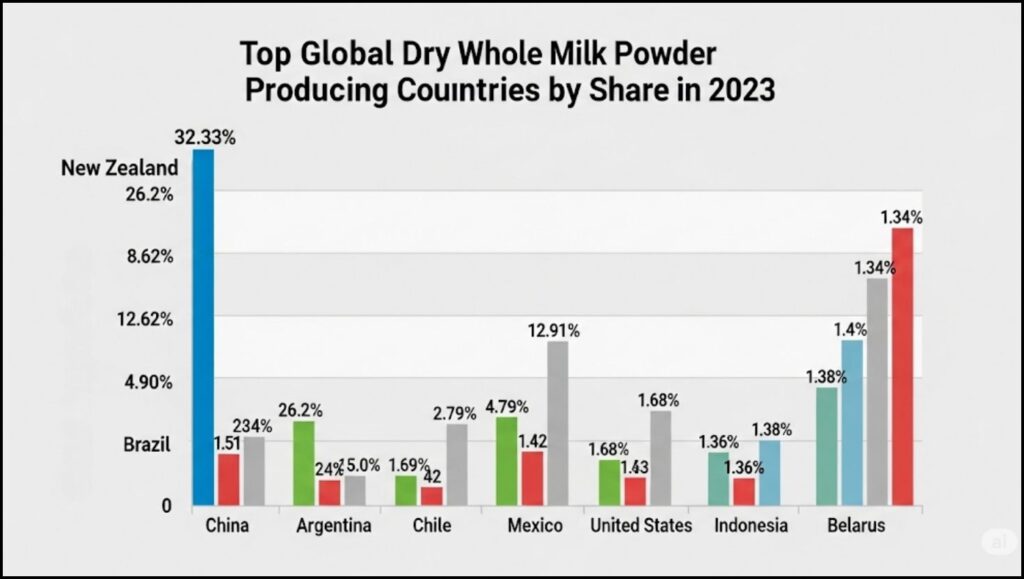

New Zealand’s dairy sector is heavily geared towards export, with a substantial portion of its milk solids converted into various dairy ingredients, including whole milk powder and skim milk powder. In 2023, New Zealand led global dry whole milk powder production, maintaining a stable and significant share of the market, according to data from Reportlinker. This reflects the country’s strategic focus on processing raw milk into higher-value, shelf-stable products that can be efficiently transported worldwide.

The cooperative Fonterra, New Zealand’s largest dairy company, plays a crucial role in this leadership. Fonterra collects approximately 84% of New Zealand’s milk supply, processing vast quantities into dairy ingredients for global markets. In October 2024, Fonterra reported robust milk production growth, with its total season-to-date milk collection reaching 512.2 million kilograms of milk solids, underscoring its significant output (Dairy Business Middle East & Africa).

Key Global Producers and Market Dynamics

While New Zealand leads in milk powder exports, other countries are also significant players in the production landscape. China, Brazil, and Argentina are notable producers of dry whole milk powder. China has shown significant growth in its production, increasing by 4.02% year-on-year in 2023. Brazil and Argentina also contribute substantially to global supply, though their production levels saw slight declines and modest increases, respectively, in the same period (Reportlinker). The United States, a major global milk producer, also contributes to the milk powder market, although its primary dairy output is often directed towards domestic consumption and other dairy products like cheese and fluid milk.

The Role of Exports in the Global Dairy Trade

The global dairy trade is heavily influenced by milk powder, which serves as a vital ingredient for various food products worldwide, from infant formula to confectionery. New Zealand consistently ranks as one of the top milk-exporting nations by revenue across all dairy products. In 2023, New Zealand accounted for 21.2% of total international milk exports, valued at $6.8 billion, demonstrating its export-oriented strategy (Tendata Global Trade Data). Germany, the Netherlands, and the United States are also significant dairy exporters, but New Zealand’s focus on milk powder gives it a unique advantage in this specific segment.

The ability to efficiently convert liquid milk into a stable, transportable powder allows New Zealand to supply distant markets and meet varying demands for dairy ingredients. This is particularly important for regions with insufficient domestic milk production or those seeking specific dairy components for their food industries.

Challenges and Future Outlook

The global dairy industry, including milk powder production, faces several challenges. Climate change poses a significant threat, with extreme heat impacting milk yields. A study published in Science Advances found that one day of extreme heat can cut milk production by up to 10 percent, with cooling technologies only partially offsetting these losses. Top milk-producing countries like India, Pakistan, and Brazil could see average daily milk output decline by 3.5% to 4% without sufficient adaptation, and even with cooling, losses are projected between 1.5% and 2.7% per cow per day (The Institute for Climate and Sustainable Growth, University of Chicago).

Economic volatility, trade policies, and evolving consumer preferences also influence the dairy market trends. The demand for value-added dairy products, including specialized milk powders, is on the rise, driven by increasing health awareness and a growing middle class globally. Technological advancements in dairy farm management, processing, and supply chain logistics are becoming increasingly crucial for maintaining efficiency and product quality.

Despite these challenges, the demand for milk powder is expected to remain robust, especially with population growth and rising incomes in emerging economies. New Zealand’s established infrastructure and export focus position it well to continue leading the milk powder industry in the coming years, adapting to market shifts and environmental considerations.