Mexico and Spain continue to dominate the global strawberry trade in 2025, maintaining their positions as the world’s leading suppliers. However, analysis of the latest trade data reveals a market in flux, with rising competition from North African nations and persistent challenges from climate change and labor costs reshaping the competitive landscape for one of the world’s most popular fruits.

The global strawberry market, valued at over $10 billion in exports, is being significantly influenced by consumer demand for year-round availability. This demand has intensified competition among the top strawberry exporting countries, forcing producers to innovate in cultivation and logistics, according to a recent report from the Food and Agriculture Organization (FAO) of the United Nations.

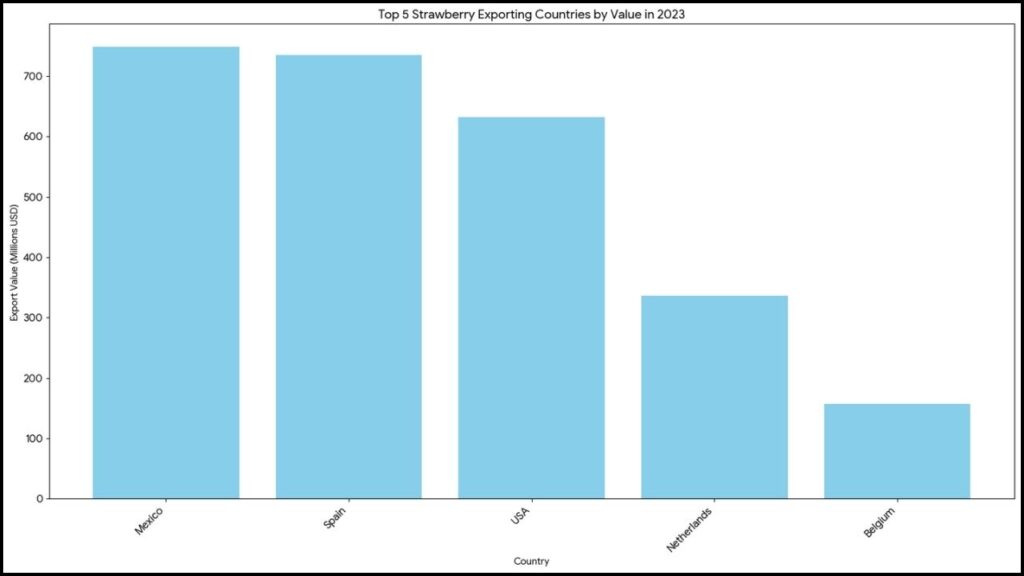

Top Strawberry Exporting Countries in 2025

| Key Fact | Detail / Statistic |

| Top Exporter | Mexico retains its #1 position, with projected export values exceeding $3 billion. |

| European Leader | Spain remains the top supplier to the European Union but faces pressure on volume. |

| Emerging Competitor | Morocco’s exports have grown by over 20% in the last three years. |

| Market Driver | Year-round consumer demand in North America and Europe. |

A Look at the Top Strawberry Exporting Countries

Based on projections from 2024 trade figures and early 2025 reports, Mexico has solidified its role as the world’s foremost strawberry exporter by value. The country’s strategic geographic proximity to the United States—the world’s largest importer—and its extensive use of protected cultivation methods like tunnels and greenhouses allow for a consistent supply that meets North American demand throughout the winter and spring months.

“Mexico’s dominance is a story of logistics and strategic investment,” said Dr. Maria Flores, an agricultural economist at the University of California, Davis. “Their ability to deliver fresh berries to U.S. supermarkets within 48 hours of picking provides a significant competitive advantage that is difficult for overseas producers to match.”

Spain, the long-standing leader in the European market, holds the second position globally. The Huelva region in Andalusia remains the heart of European strawberry production. However, Spanish growers are contending with significant headwinds, including severe drought conditions that have impacted water allocations and rising labor costs across the European Union. Following the top two are the United States, primarily from its California and Florida production, which serves both domestic and Canadian markets, and the Netherlands, a key player in greenhouse technology and re-exporting. Notably, Morocco has rapidly climbed the ranks, now firmly established as a top five exporter and a direct competitor to Spain in the European market.

Economic and Climate Pressures Reshape Trade

The key factors influencing the global strawberry market in 2025 are increasingly economic and environmental. In Spain, multi-year droughts have forced a reckoning within the agricultural sector. The Spanish Ministry of Agriculture, Fisheries and Food has reported a slight but noticeable contraction in cultivation area as water rights become more contentious.

“We are not just competing on price anymore; we are competing with the climate,” stated a representative from Freshuelva, the Spanish association of strawberry producers, in a recent industry press release. “Investment in water-efficient irrigation and drought-resistant cultivars is no longer optional, it is essential for survival.”

This has created an opening for countries like Morocco and Egypt. With lower labor costs and favorable climates, these nations are rapidly expanding their agricultural exports to Europe. They offer a cost-competitive alternative, particularly during the early winter months, and have heavily invested in logistics to improve their supply chains into key markets like Germany, France, and the United Kingdom.

Technological Innovation and Consumer Trends

Beyond weather and economics, advancements in agricultural technology are playing a crucial role. The adoption of soilless cultivation (hydroponics) in countries like the Netherlands and the development of new berry varieties with longer shelf lives and improved disease resistance are shaping the industry. These innovations allow for more predictable yields and a higher quality product that can withstand long-distance shipping.

Consumer preferences are also steering the market. A growing demand for organic and sustainably grown produce has created niche, high-value markets. Exporters who can provide certification and traceability for their products are increasingly able to command premium prices.

Looking ahead, the global strawberry trade is expected to remain highly competitive. While Mexico and Spain are likely to hold their top spots in the near term, the pressure from emerging exporters and the urgent need to address climate-related production risks will continue to define the industry. The ability to adapt through technology and sustainable practices will ultimately determine the leading suppliers of tomorrow.

Mexico Solidifies Position as the Largest Papaya Exporter in the World