The popular neighborhood grocery chain Trader Joe’s has announced plans for a significant nationwide expansion, with the company confirming its intention to open more than 30 new stores. This move signals the company’s confidence in its brick-and-mortar strategy amidst a competitive and evolving grocery store expansion landscape, promising to bring its unique product selection to several new American communities.

Key Highlights of the Trader Joe’s Expansion

| Key Fact | Detail / Statistic |

| Expansion Scope | “More than 30” new stores planned, with some already under construction. |

| Company Strategy | Growth is fueled by a debt-free status and reinvestment into stores and staff. |

| Market Position | The expansion runs counter to some retailers’ focus on e-commerce, reaffirming a commitment to the in-store experience. |

| Consumer Appeal | Trader Joe’s model is built on private-label products, curated selection, and customer service. |

A Counter-Current in the Retail Tide

In an era where many retailers are focused on digital integration and massive e-commerce platforms, Trader Joe’s is doubling down on its physical presence. The plan for Trader Joe’s new stores was confirmed by company executives during a recent episode of the “Inside Trader Joe’s” podcast. CEO Bryan Palbaum and President Jon Basalone stated the company is actively looking to bring its stores to more neighborhoods across the United States.

“We’ve got a plan, and that plan is to grow,” Basalone said on the podcast. He confirmed that “more than 30” new locations are in various stages of development, from initial site selection to active construction. This represents one of the most aggressive growth phases for the typically cautious and tight-lipped company in recent years.

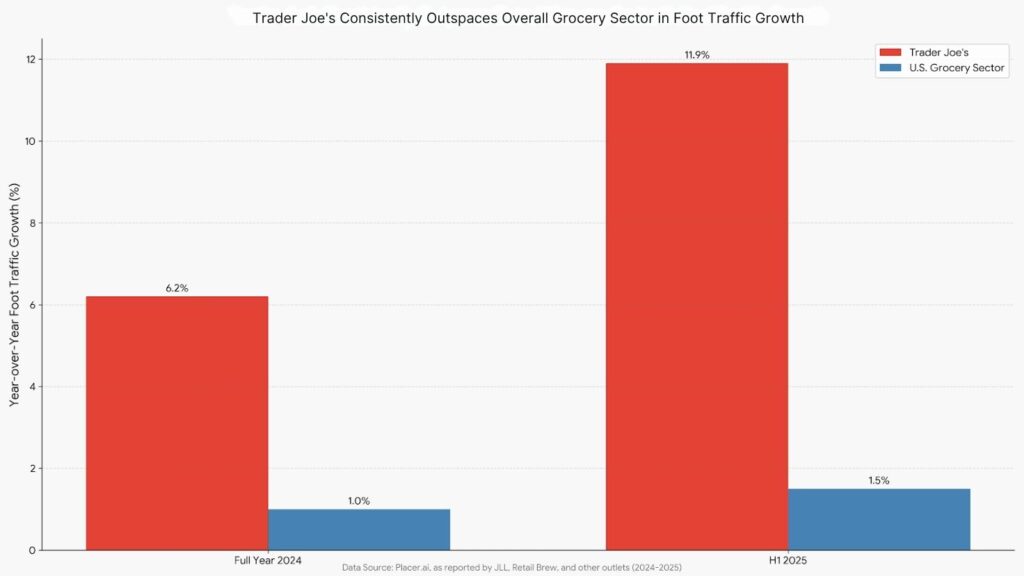

This expansion is particularly noteworthy given the current economic climate. While inflation has strained consumer budgets and forced many grocery chains to compete fiercely on price, Trader Joe’s has maintained strong customer loyalty. According to data analytics firm Placer.ai, foot traffic at Trader Joe’s has consistently outperformed the wider grocery sector, a key indicator of its robust health and appeal.

The Strategy Behind the Grocery Store Expansion

Analysts point to several factors fueling the company’s confidence. Unlike publicly traded competitors, the privately held company, owned by Germany’s Aldi Nord, is not beholden to shareholder demands for quarterly profit growth. This allows for a more long-term, deliberate strategy. During the podcast, Palbaum emphasized that Trader Joe’s is “debt-free” and reinvests its earnings back into the business—primarily into its stores and crew members.

“Trader Joe’s has a formula that works, and they are wisely choosing to scale it without breaking it,” said Neil Saunders, Managing Director of Global Data Retail, in a commentary on the grocery market. “Their smaller store footprint, focus on high-value private label products, and curated inventory create a treasure hunt experience that larger supermarkets can’t easily replicate. This fosters a destination status rather than just a place for weekly essentials.”

This business model helps insulate the company from some inflationary pressures. With approximately 85% of its products sold under its own brand, Trader Joe’s has more direct control over its supply chain and pricing compared to retailers reliant on national brands.

Where Are the New Stores Opening?

While the company has not released a comprehensive list of all 30-plus locations, several new stores have been officially confirmed and are listed as “coming soon” on the Trader Joe’s website. These include:

- San Francisco, California: A new outpost in the Hayes Valley neighborhood.

- Houston, Texas: A new location set to serve the suburbs.

- New Jersey: Confirmed openings in Middletown and Montvale.

- Maryland: A new store is planned for Gaithersburg.

- Oregon: Residents in Happy Valley can expect a new location.

This geographic spread indicates a strategy of deepening its presence in existing strongholds like California while also expanding into new suburban markets. The company’s real estate team is known for its meticulous site selection process, prioritizing locations with high population density, favorable demographics, and good accessibility.

Impact on Local Economies and Competition

The announcement is welcome news for job seekers and local economies. Each new Trader Joe’s store typically creates dozens of jobs, known within the company as “Crew Members,” with wages and benefits that are often competitive for the retail sector.

The expansion will also intensify competition in the $800 billion U.S. grocery industry. Traditional supermarkets like Kroger and Albertsons, as well as specialty retailers like Whole Foods Market, will face increased pressure in markets where new Trader Joe’s locations open. The chain’s ability to attract a loyal following can significantly alter local shopping patterns and consumer trends.

As Trader Joe’s forges ahead with its expansion, its leadership maintains that the core philosophy will not change. The focus remains on the in-store experience, product innovation, and customer service. “We’re just going to keep doing what we’re doing,” Basilone concluded on the company podcast, a statement reflecting a quiet confidence that has defined the brand for decades.

Aldi July Finds: 10 Seasonal Products Highlighting Summer Grocery Trends