China stands as the undisputed global leader in wheat flour production, driven by immense domestic demand and vast agricultural output. This East Asian powerhouse consistently outpaces other nations, underpinning its significant role in global food security and the broader wheat flour producer.

China’s Dominance in Wheat Production

China’s position as the world’s largest wheat flour producer is intrinsically linked to its extensive wheat cultivation. In the 2023/2024 marketing year, China produced over 136 million metric tons of wheat, maintaining its top rank globally. This substantial output is crucial for feeding its population of over 1.4 billion people, who rely heavily on wheat-based products as a staple. Despite its leading production, China is also the world’s largest consumer of wheat, indicating a significant domestic demand that largely absorbs its massive output. The nation’s agricultural policies often prioritize self-sufficiency in key grains, including wheat, to ensure food security.

Key Factors Behind China’s Production Prowess

Several factors contribute to China’s formidable capacity in wheat flour production. These include vast arable land, particularly in its northern plains, favorable climatic conditions for wheat cultivation, and extensive investment in agricultural technology and irrigation systems. The government’s emphasis on modernizing farming practices and providing subsidies to farmers has also played a crucial role in boosting yields and overall output.

However, recent challenges, such as heavy rainfall just before harvest in leading wheat-producing regions in 2023-2024, have sometimes impacted the quality of the crop, leading a higher proportion to be used for animal fodder rather than direct human consumption, according to a report by Development Aid. Such events highlight the vulnerabilities even for the largest producers.

Global Wheat Landscape: Other Major Players

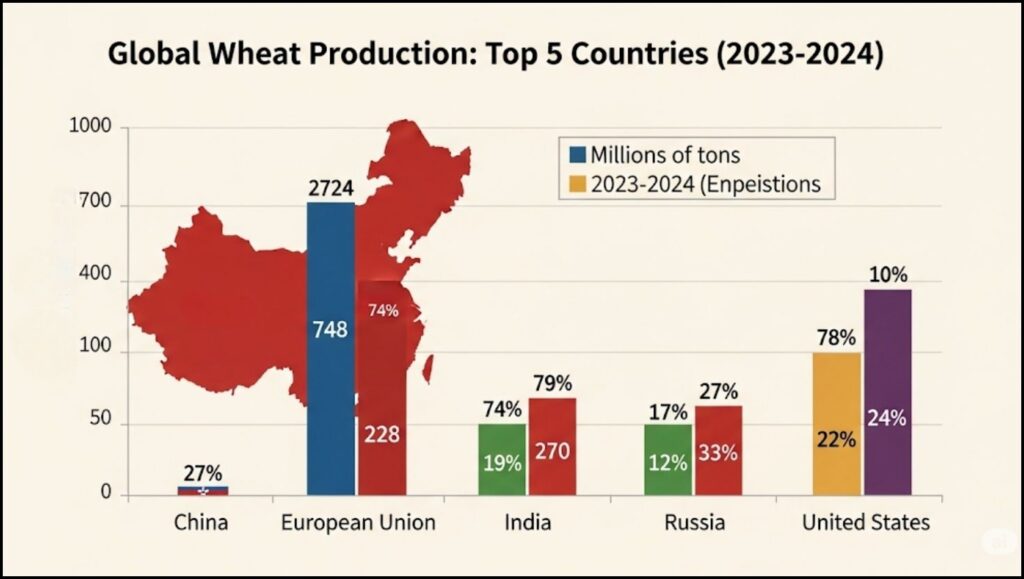

While China leads in overall wheat production, other countries and regions are significant contributors to the global wheat supply. The European Union collectively stands as the second-largest wheat producer, with over 133 million metric tons in the 2023-2024 marketing year. Wheat accounts for more than 50% of the cereals farmed in the EU, and approximately 20% of its wheat crop is exported, serving the rising global demand for processed foods.

India ranks third, producing over 110 million metric tons of wheat in 2023-2024. As one of the most populated countries, India, like China, primarily consumes most of its domestic wheat output. Russia, a major wheat exporter, produced 91 million tons, securing its place as the fourth-largest producer. The United States and Canada also feature prominently among the top global wheat producers and exporters.

The Wheat Flour Market: Beyond Raw Production

The journey from raw wheat to wheat flour involves significant industrial processing. The global wheat flour market was valued at approximately USD 173.02 billion in 2023 and is projected to grow to USD 250.15 billion by 2032, exhibiting a Compound Annual Growth Rate (CAGR) of 4.22% during the forecast period, as reported by Fortune Business Insights. This growth is driven by increasing demand for baked goods, noodles, pasta, and convenience foods worldwide.

Turkey, while not a top-tier wheat producer globally, holds a notable position as a leading exporter of wheat flour. In 2023, Turkey was the top exporter of wheat flours by value, with approximately $1.5 billion in exports, according to OEC (Observatory of Economic Complexity). This indicates a robust milling industry and strategic trade position, converting raw wheat (both domestically produced and imported) into processed flour for international markets.

Challenges and Future Outlook for Wheat Production

The global wheat flour landscape faces several challenges that could impact future production and prices. Climate change, with its increasing frequency of extreme weather events such as droughts and floods, poses a significant threat to crop yields in major producing regions. For instance, an increase in temperature by 1°C is projected to reduce wheat production in India by 4 to 5 million metric tons, even with CO2 fertilization benefits, according to research. Shifting growing zones and increased pest and disease patterns are also concerns for wheat cultivation.

Geopolitical tensions and trade policies further complicate the global wheat market. Export restrictions and disruptions to supply chains can lead to price volatility and impact food security in net-importing countries. Global wheat production for the 2024/25 harvest season is estimated to be 793.24 million tons, a slight reduction from the previous harvest, with declines in key producers like Russia and the European Union partially offset by gains elsewhere, as per the WASDE-USDA report released in January.

Despite these challenges, the demand for wheat and wheat flour continues to rise due to global population growth and evolving dietary habits, particularly in developing countries. This sustained demand underscores the vital importance of resilient wheat cultivation and efficient distribution networks to ensure a stable supply for the future. China’s sustained leadership in wheat and wheat flour production remains a cornerstone of the global food system. While its sheer scale of output is unmatched, the intricate dynamics of the global wheat market are shaped by diverse producers, complex trade relationships, and the overarching impacts of climate change and geopolitical factors. Monitoring these multifaceted elements will be critical for understanding the future of this essential commodity.

Urban Harvests Get an Upgrade: Inside the Trend of Automated Raised Bed Plumbing Systems