Ukraine has firmly held its position as the world’s largest sunflower oil producer, a title it has maintained for years despite significant geopolitical and logistical challenges. The nation’s fertile black soil, known as chernozem, has long made it a dominant force in the global agricultural market, with sunflower seeds being one of its most critical and profitable crops. This production is not only a cornerstone of the Ukrainian economy but also a vital component of the global edible oil supply chain, with the country and its neighbor, Russia, historically accounting for a majority of the world’s output and exports.

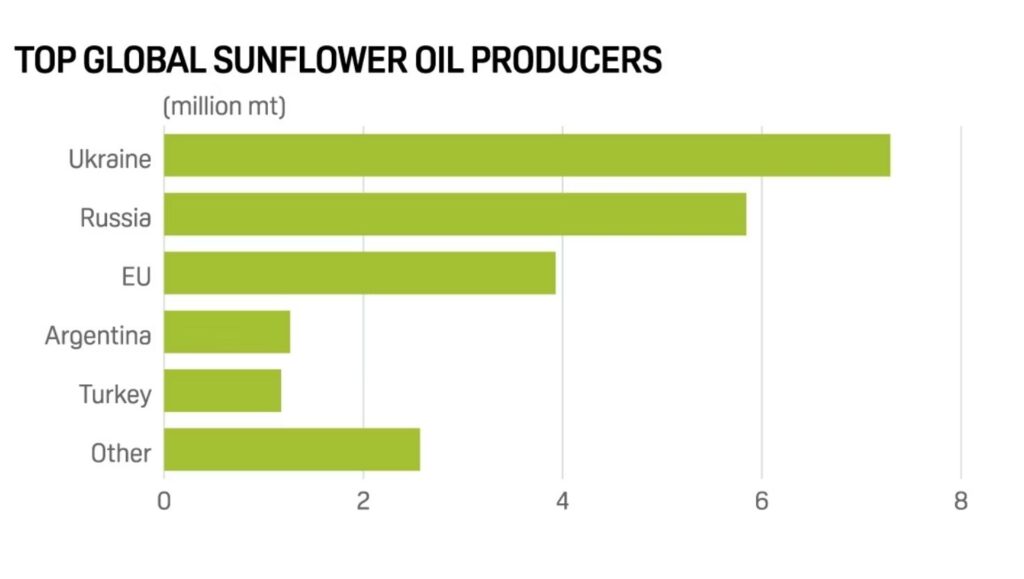

Ukraine and Russia are by far the two largest producers and exporters of both sunflower seeds and their resulting oil. Data from various sources, including the U.S. Department of Agriculture (USDA) and industry analysts, consistently show these two nations producing well over half of the world’s total supply. The dominance of this Black Sea region makes the global market for sunflower oil particularly sensitive to political instability and other disruptions within this area.

A Look at Ukraine’s Production and Export Prowess

Ukraine’s agricultural sector has been built around its rich soil and ideal climate for cultivating crops like sunflowers. Prior to recent conflicts, the country was producing between 14 and 16 million metric tons of sunflower seeds annually, representing a substantial portion of the world’s total. A significant majority of these seeds are crushed domestically to produce sunflower oil, which is then primarily exported. This robust infrastructure and export-oriented production model have solidified Ukraine’s role as a key supplier to international markets.

The European Union and countries in Asia and the Middle East are major importers of Ukrainian sunflower oil. The oil’s popularity is driven by its neutral flavor, high smoke point, and perceived health benefits due to its high content of unsaturated fatty acids. These characteristics have made it a staple in household kitchens and food processing industries globally. The sunflower oil market is also experiencing growth in the high-oleic segment, a variety prized for its extended shelf life and stability, further boosting demand for specialized Ukrainian products.

Geopolitical Factors and Market Volatility

The concentrated nature of sunflower oil production presents a significant risk to the global market. Recent geopolitical events have profoundly impacted the supply chain, leading to price volatility and prompting food manufacturers and consumers to seek alternative oils. According to a report by ChemAnalyst, the global sunflower oil market experienced significant pressure from both production fluctuations and geopolitical tensions.

Supply chain disruptions from the Black Sea region have created bottlenecks and limited access to critical crushing capacity for Ukrainian producers. This has forced major importers to find new sources or switch to other vegetable oils like palm or soybean oil. The market volatility is also reflected in price surges for agricultural inputs, such as fertilizers and energy, which are passed on to consumers.

The impact of these disruptions is not only on the availability of oil but also on the economies of countries that rely heavily on these exports. The Ukrainian economy, in particular, is intrinsically linked to the performance of its agricultural sector. The USDA has noted that, over the next decade, while Ukraine’s grain and sunflower seed exports are projected to stabilize, they are likely to remain at lower levels than before the conflicts began, with little to no growth expected.

Key Competitors and the Global Market Landscape

While Ukraine holds the top spot, Russia is a close competitor and a major player in its own right. The two countries together account for the lion’s share of the global sunflower oil supply. The dominance of these two nations is a defining feature of the global edible oils market.

However, other countries also contribute to the global supply. Argentina is a significant producer in South America, while the European Union, particularly countries like Romania and Bulgaria, also has a notable presence. Other players include Turkey and China, which are major importers and also have domestic production. The diversity of these producers, even if smaller in scale, provides some level of redundancy in the market.

The Role of Technology and the Future of the Industry

In response to market pressures, the sunflower oil industry is undergoing shifts driven by both technology and changing consumer preferences. Farmers are increasingly adopting high-quality hybrid sunflower seeds with desirable traits like improved drought tolerance and higher yields. This modernization of farming techniques has been a key factor in boosting productivity, particularly in Ukraine, where yields have significantly outpaced those in other regions over the past two decades.

The global demand for healthy cooking options continues to grow, and sunflower oil is well-positioned to capitalize on this trend. Its high vitamin E content and favorable fatty acid profile appeal to health-conscious consumers. The use of sunflower oil is also expanding beyond the food industry, with applications in biofuels, personal care products, and industrial lubricants.

The future of the global sunflower oil market remains intertwined with the geopolitical stability of the Black Sea region. While Ukraine and Russia are expected to remain the principal producers, the ongoing challenges are prompting market players to diversify their sourcing and explore new agricultural technologies. The situation highlights the fragility of a global food system reliant on a few key suppliers and the importance of resilience and adaptability in a changing world.